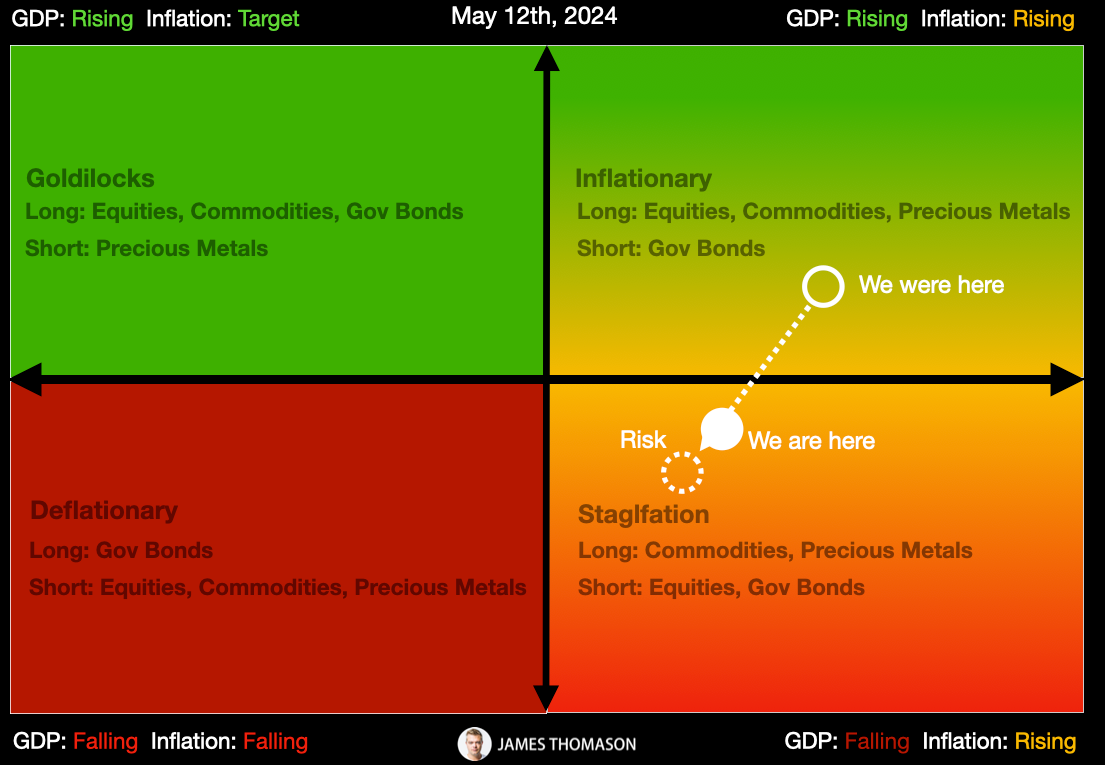

The economy dipped further into stagflation the past two weeks as the battle of fiscal versus monetary policy reached its predictable stalemate. There was a lot of macro data released together with large cap earnings to create an overall mixed picture for tech stocks. Government and AI-driven infrastructure spending continue to be hot spots even as market returns suggest a further shift to risk-off.

Macro

The US government continues to spend with reckless abandon and is on track to end the fiscal year more than $1.5 trillion in the red. Currently, there is no cap on government spending until 2025 due to the debt ceiling deal that was negotiated in 2023. This agreement essentially suspended the debt limit until January 2025, allowing the U.S. government to borrow as needed to fund its operations without a specific cap.

Fed officials continue to stick to the higher-for-longer narrative, because what choice do they have? The Fed's attempt to control inflation through higher interest rates is at direct odds with the governments stimulus spending and there is nothing they can do about it.

The Fed cannot raise rates because it risks further destabilizing the banking system and drawing the ire of political interests in a presidential election year. Despite intense political pressure, the Fed cannot lower rates or it risks further igniting inflation.

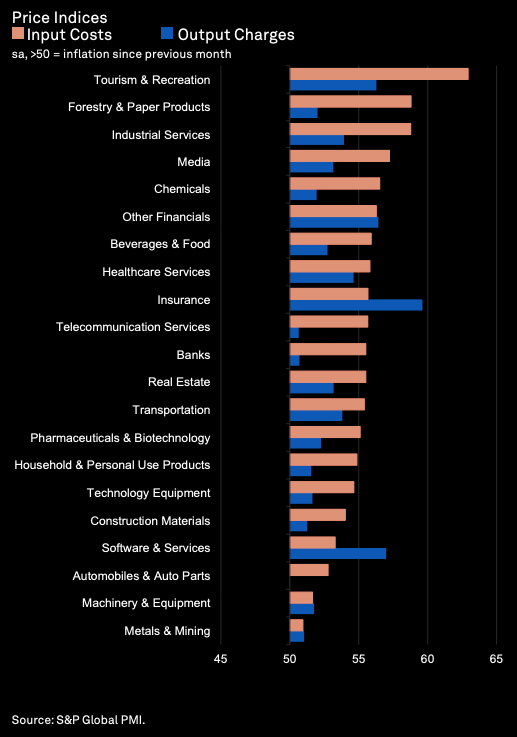

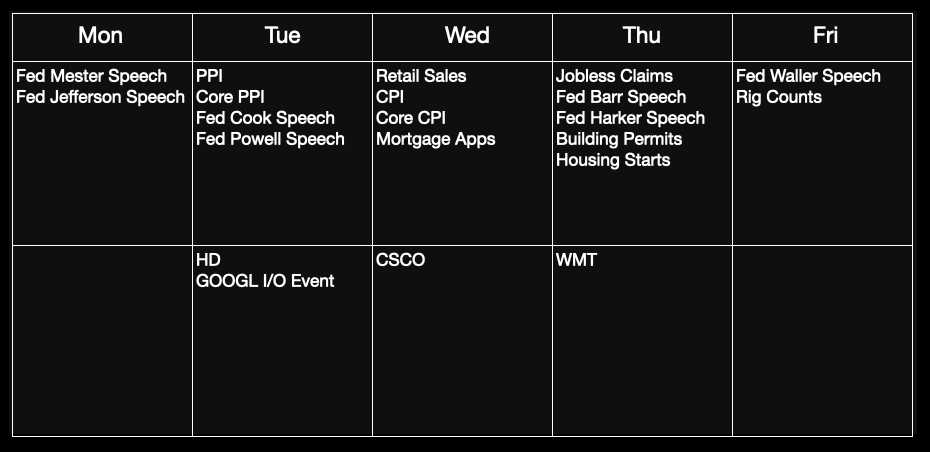

Meanwhile, the latest S&P Global Sector PMI showed price input and output increases across all 21 sectors tracked, a persistent trend since December 2023. Along with the latest M2 data, it suggests Core CPI and PCE could come in higher than expected this week.

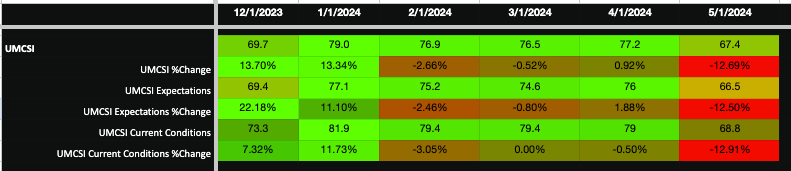

The drop in consumer confidence indicated by the UMCSI was the largest month-over-month decrease since May of 2023 and is surprising in an economy that allegedly boasts low unemployment.

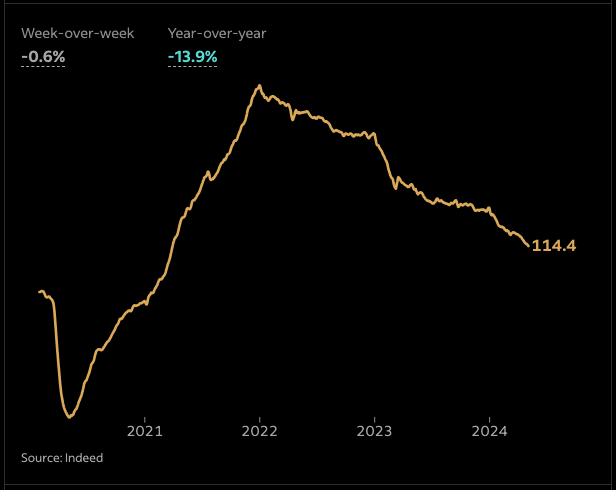

Leading indicators of employment suggest headline job data may be overstated. Job listings on Indeed continued to decline as California unemployment increased to 5.3%, the highest in the nation.

Market

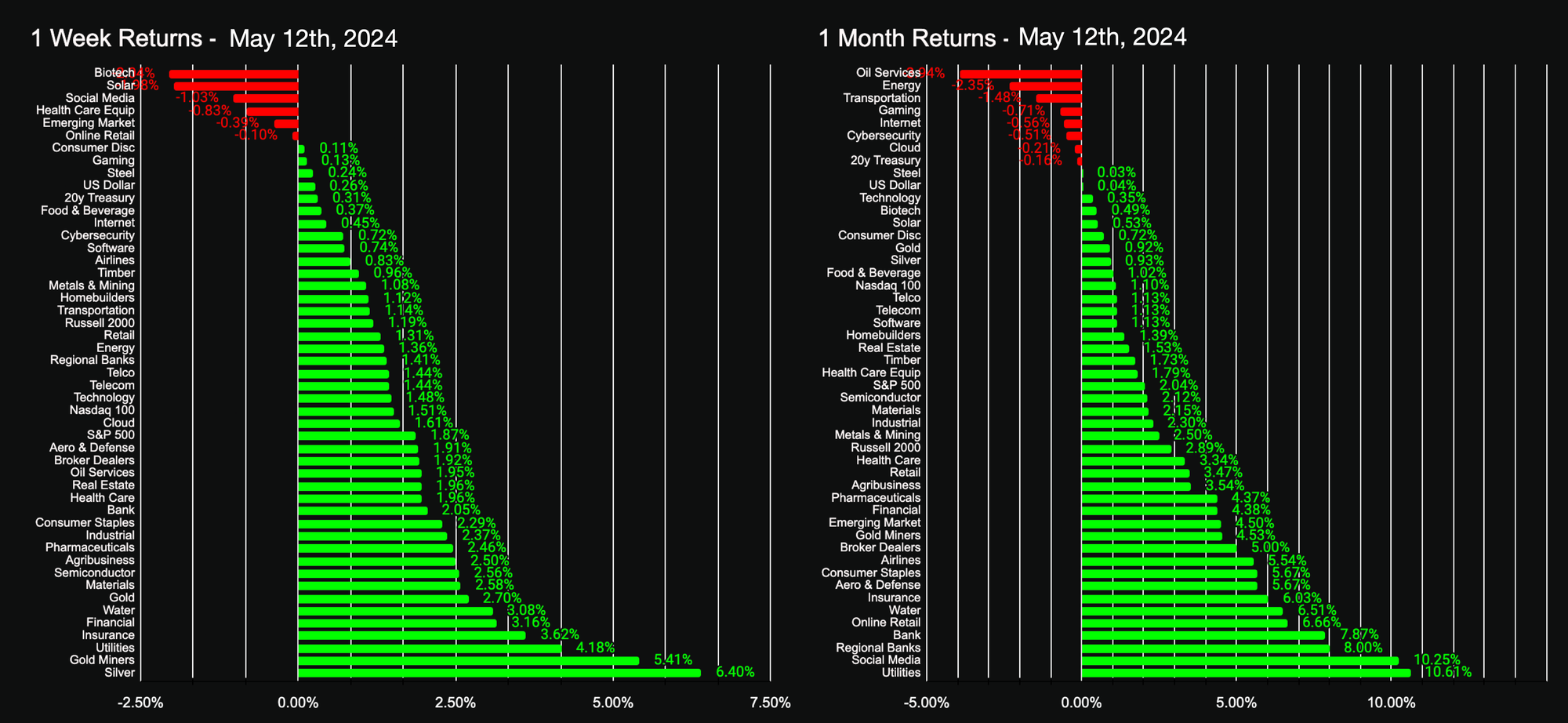

Utilities were the star performer over the last month with many utility stocks looking like high-flying growth stocks as funds sought shelter in low beta. Precious metals, consumer staples, and financials continued to advance over cyclical tech, with the bright spots in tech being cloud and semiconductors driven by AI infrastructure spending. This continues to tell a "risk-off" story for cyclicals including consumer discretionary and most tech.

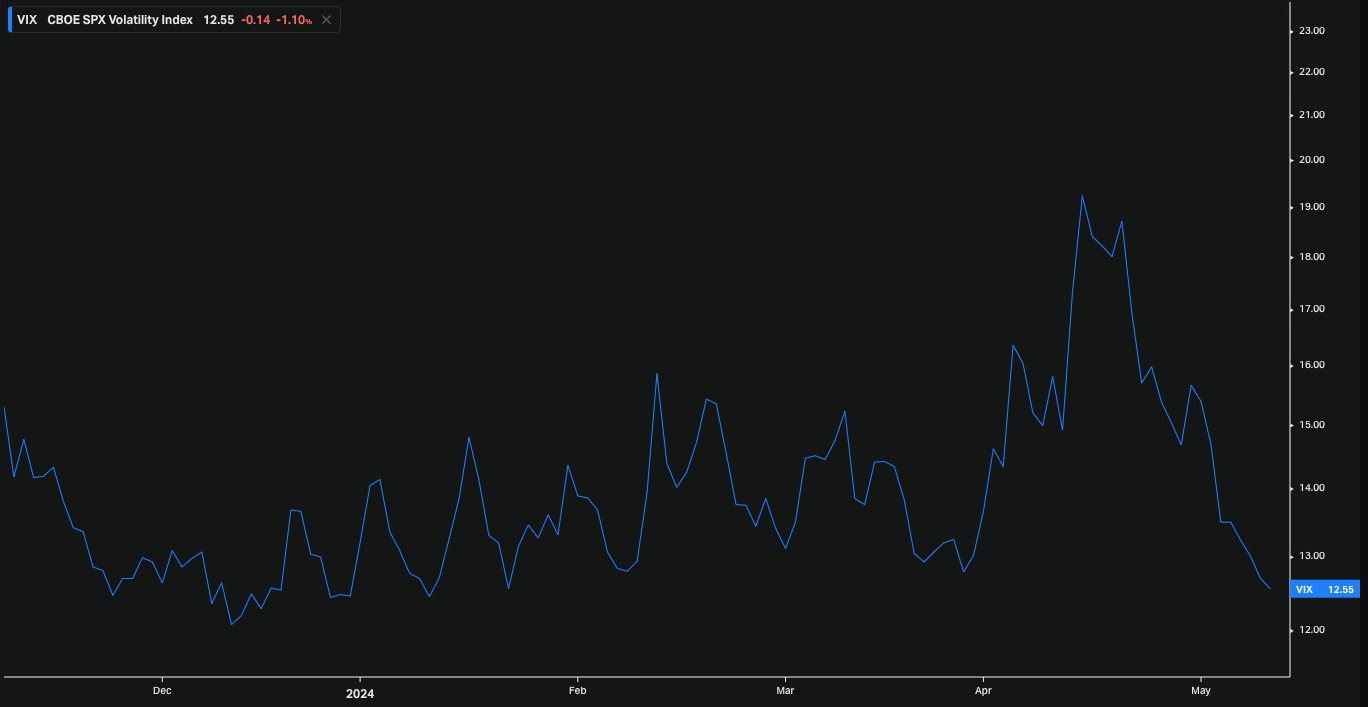

Given the macro and geopolitical situation, the low level of implied volatility and the speed at which volatility reverted was surprising. I am not sure if this is due to systematic selling of implied volatility through structured products, or if this simply an underpricing of risk. However, it makes for very affordable tail risk hedging in a fairly risky environment through index puts.

Positioning

My view remains unchanged: GDP momentum continues to slow with the potential for negative earnings surprises and/or lowered guidance which is overall negative risk for tech stocks. This is a market-neutral to "weak" short thesis as there is not yet evidence of contraction in GDP. I still see potentially a more prolonged shift into stagflation with a lot of macro uncertainty as the Fed is immobilized.

Catalysts

I expect the inflation print to be hot given indications in earnings reports, PMIs, and consumer price data. Watch Home Depot earnings with interest for indications of consumer spending.

Tech Pulse

Artificial Intelligence is still the growth story for infrastructure, cloud, and semiconductor companies, while SaaS and Software face headcount reductions, budget caps and cuts.

Cisco (CSCO)

Earnings this week on Weds, which I expect will disappoint. Cisco is a company that stopped innovating a long while ago and I think it is not well-positioned to benefit from the AI-driven infrastructure spending.

Google (GOOGL)

Alphabet Inc.'s Q1 2024 earnings report gave a positive guidance, with a 15% increase in revenues to $80.5 billion, driven by strong performance in Search and YouTube, as well as a 28% growth in Google Cloud revenues. The company also managed a 400 basis point expansion in operating margin. Alphabet's investments in technical infrastructure and AI indicate robust future growth prospects, especially in cloud computing and AI-driven services. The Google I/O event is this week in Mountain View and will undoubtedly feature many announcements. More on Google later this week. I have written previously why I am a believer in Google's ability to reclaim a lead in AI.

Meta (META)

Meta Platforms reported total revenue of $36.5 billion, up 27% year-over-year, with strong growth across its Family of Apps segment. The company provided Q2 2024 revenue guidance in the range of $36.5 billion to $39 billion. Meta also updated its full-year 2024 expense outlook to $96-99 billion, up from $94-99 billion, due to higher infrastructure and legal costs. Additionally, the company increased its full-year 2024 capital expenditure guidance to $35-40 billion, up from $30-37 billion, as it accelerates infrastructure investments to support its AI roadmap.

Meta may have wasted time on the metaverse but it is quickly turning the ship to chase AI. I am becoming a believer in their open strategy on the basis of the latest Llama-3 model results. More on Meta's AI strategy soon in a dedicated article.

Microsoft (MSFT)

Microsoft reported record results with revenue of $61.9 billion, up 17% year-over-year, and EPS of $2.94, up 20%, exceeding expectations. The strong performance was driven by Microsoft Cloud, which surpassed $35 billion in revenue, up 23%, with Azure revenue growing 31% and Azure AI services contributing 7 points of growth. Microsoft is seeing strong adoption of its AI offerings, including Microsoft 365 Copilot and GitHub Copilot.

For Q4, the company expects continued double-digit revenue and operating income growth, with Azure revenue growth of 30-31%, though near-term AI demand is outpacing current capacity. Microsoft guided to another year of double-digit top and bottom-line growth in fiscal 2025, with operating margins expected to be down only about 1 point year-over-year despite significant AI investments.

Microsoft has its 2024 Build event coming up May 21-23, 2024.

Nvidia (NVDA)

Earnings coming up May 22nd. I have written previously on Nvidia's long-term strategic dilemma. The company is very likely to meet guidance but there are rumors of supply chain problems across semis that increase the risk of a negative surprise.

Tesla (TSLA)

I believe Tesla is about to fully pivot into the recurring revenue model. It would make a lot of strategic sense for Tesla to spin off or sell the auto manufacturing capacity and focus on licensing software and platform to other auto manufacturers as it shifts its focus to robotics. I'll discuss more on this in an article later this week.

Tesla's Q1 2024 results showed a $2.5 billion negative cash flow driven by inventory mismatches and high capital expenditures. Tesla's narrative on heavy reliance on the success of Full Self-Driving (FSD) technology as a core value driver, despite ongoing regulatory and technological hurdles, adds a layer of uncertainty to its future growth trajectory. The company is starting to cut deep with workforce reductions, trimming not only fat but talent in the process as shown with the RIF of the supercharger team.