The last two quarters, Oracle had so much demand for cloud, it could not build its data centers fast enough. There it was in black in white, sprung from the page from the transcript of a recent event. The realization gave me a little wince. It was time to dump my old faithful short ORCL position, right now, before the earnings report.

Wait, Oracle Has a Pulse? Better Late Than Never

For over a decade, Oracle has struggled to find its footing in the cloud era. The company was too entrenched in its on-premises software roots to quickly pivot to the cloud computing future. Worse, Oracle was initially a cloud denier, and like all cloud deniers, it didn't go very well in the end.

The stock has been a trusty, reliable under performer, the kind of short position you could add to your leveraged book of high beta hyper-growth tech stocks and never lose minute's sleep, a long drawn out wheeze from a zombie that would never awaken. You get the picture. But no more.

Naysayers like myself may have spoken too soon, it seems. Oracle's recent fiscal Q3 2024 earnings report, coupled with insights shared at its CloudWorld analyst event, paint a picture of a company that has not only embraced the cloud but may now be emerging as a formidable force.

These Numbers Don't Lie

Oracle's latest quarterly results are hard to ignore. Total revenues reached $13.3 billion, up a solid 7% year-over-year. However, the real story lies in the cloud segment's blistering growth. Cloud services and license support revenues, which include cloud infrastructure (OCI) and cloud applications (SaaS), soared to $10 billion, reflecting an 11% increase.

Even more impressive, OCI revenue alone surged 49% to $1.8 billion, with consumption revenue hitting 63%. Oracle's cloud applications business, particularly its strategic back-office SaaS suite for ERP, HCM, and supply chain management, continues gaining momentum, up 27%.

These figures aren't a flash in the pan either. Oracle's remaining performance obligation (RPO) ballooned to over $65 billion, with the Cerner acquisition excluded portion up 41% on a constant currency basis. This staggering backlog underscores the company's ability to keep landing major cloud deals.

The Cloud Shifted Perspective

Oracle's long journey from a fading on-premises software vendor, to a cloud behemoth is finally bearing fruit. While rivals like Amazon, Microsoft, and Google grabbed early cloud headlines, Oracle took the long road - redesigning its cloud infrastructure from the ground up to optimize for performance, security, and cost efficiency.

This "Generation 2" cloud approach, which Oracle has been perfecting for over a decade, is working. From what we understand, Oracle has built a highly automated bare-metal cloud designed for seamless regional expansion. With 64 modern cloud regions currently operational and plans for 100 more, Oracle can strategically place cloud capacity closer to population hubs, reducing latency issues.

Oracle Autonomous Linux, Oracle's self-driving, self-securing operating system tailored for the cloud's unique demands, is another integral part of this architecture. Coupled with the re-engineered Oracle Autonomous Database, which optimizes itself while consuming resources only when needed, Oracle has a compelling cloud platform aimed at outperforming legacy cloud rivals.

The Cloud Payoff Begins

This novel cloud foundation is already delivering for Oracle. At CloudWorld, customers like NVIDIA, Uber, FedEx, and a who's who of banks and tech giants provided glowing testimonials about OCI's advantages for resource-intensive workloads like AI training, data analytics, and B2B commerce automation.

Case in point: One major cloud rival inked a $1.5 billion deal to leverage OCI for its own AI training needs, visibly validating Oracle's price/performance leadership. Oracle also announced expanding its strategic multi-cloud partnership with Microsoft, with plans to roll out 20 interconnected OCI/Azure regions to better serve customers requiring a hybrid approach.

While OCI growth gets top billing, Oracle Cloud Applications are simultaneously gaining cloud traction. With over 5,000 customers already migrated to Fusion Cloud ERP and HCM, Oracle estimates it has only penetrated 10% of its vast on-premises applications install base. This represents an incremental $15-20 billion revenue opportunity just from converting its own captive base. If you factor in migrating competitors' stagnant on-prem customer bases to Oracle's modern cloud suite, that swells the total cloud applications opportunity to $75-100 billion.

The Generative AI Accelerator

Unlike its initial resistance to join the cloud trend, this time Oracle is already targeting generative AI as a potent accelerator for its growth ambitions. At CloudWorld, the company showcased its new AI cloud services built around partnerships with leading AI innovators like NVIDIA and Cohere.

By infusing applications like ERP, HCM and supply chain with generative AI capabilities, Oracle can further differentiate its cloud offerings while embedding valuable new AI-driven capabilities. For instance, Oracle demonstrated how voice-based "clinical digital assistants" can streamline healthcare workflows by automatically transcribing physician-patient interactions into medical notes, orders and EHR updates.

Autonomous database enhancements like AI vector processing and retrieval-augmented generation also position Oracle to capture lucrative emerging AI workloads around large language model training and tuning. Announcing over $4 billion in pre-committed AI deals, Oracle made a compelling case that its unified cloud stack spanning hardware to applications gives it critical advantages for the AI era.

The Healthcare Transformation Driver

While Oracle has cloud opportunities across industries, perhaps no vertical is more strategically important than healthcare and life sciences. The company's landmark $28 billion acquisition of Cerner, the leading health IT platform for providers like hospitals and clinics, was initially viewed skeptically. However, Oracle is now articulating an audacious vision to modernize and expand the Cerner suite into an AI-fueled, cloud-based healthcare automation juggernaut spanning the entire ecosystem.

With Cerner's electronic health records (EHR) already running on the Oracle database, Oracle is now migrating these mission-critical workloads to the OCI cloud, infusing them with autonomous capabilities and advanced analytics. From drug discovery to clinical trials, patient administration to revenue cycle management, Oracle aims to capitalize on a greenfield opportunity to fully automate healthcare delivery, payment and compliance across providers, payers, life sciences, and even national health services.

Remarkably, Oracle is already announcing $1 billion+ cloud healthcare deals with entire countries looking to harness autonomous AI capabilities like real-time population health monitoring and precision medicine. Oracle's Cerner integration combined with its data management and cloud infrastructure prowess uniquely positions it to disrupt the fragmented, data-siloed healthcare industry.

The Oracle Cloud Revival Roadmap

Of course, transitioning to a born-again cloud titan won't happen overnight for Oracle. The company readily admits moving its massive install base from legacy on-premises systems to next-gen cloud services is a long journey. Fiscal 2024 revenue growth, projected at 7% including Cerner's headwinds, reflects Oracle is still in the cloud migration phase.

However, Oracle remains firmly committed to its Fiscal 2026 goals of reaching $65 billion in revenue, 45% operating margins, and sustaining double-digit EPS growth as its cloud business scales. Management hints these public forecasts could prove conservative if Oracle's accelerating cloud momentum persists.

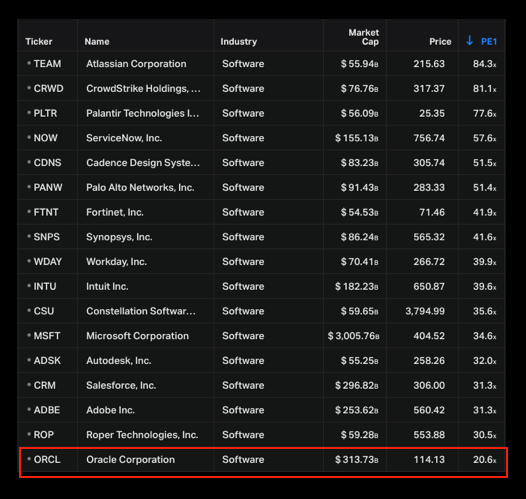

I can't believe I am saying this, but this could set up a value-to-growth story for Oracle's stock. The company's resilient profitability and prodigious cash flows, driven by its sticky on-premises support contracts, provide a stable floor. But it's the cloud growth kicker that could really juice Oracle's earnings power and rerate shares higher.

Right now market consensus is still pricing Oracle's earnings dead last among the other software large caps. But it is our job to find opportunities before others see them, is it not?

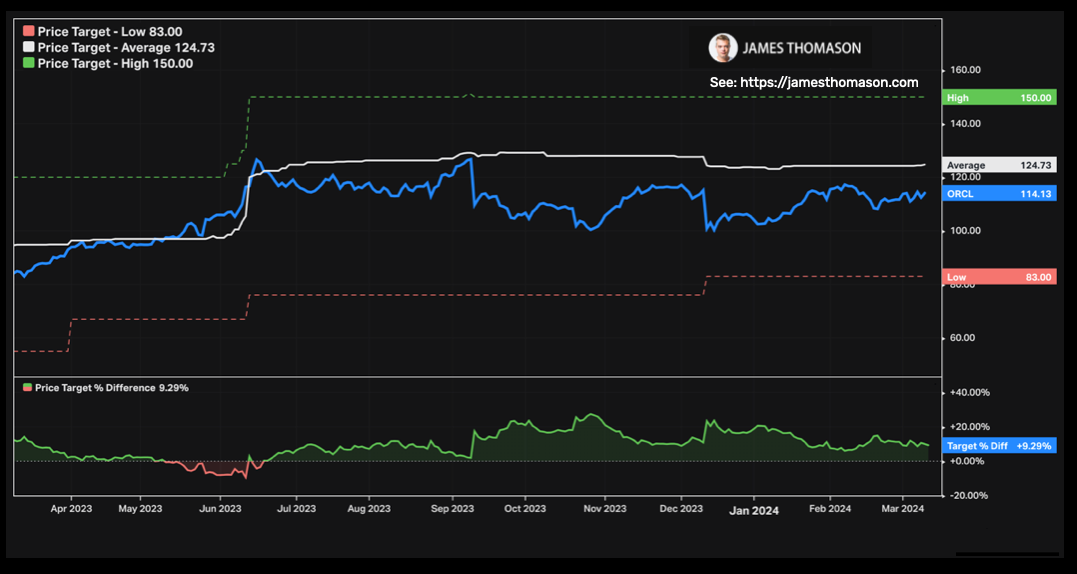

Consider this: consensus estimates peg Oracle's fair value around $124 with bulls seeing $150 or more. I think those projections arguably fail to fully capture Oracle's cloud opportunity, particularly in mega-growth areas like AI and healthcare. As more of Oracle's cloud deals ramp and recently announced cloud bookings translate to revenue, estimates will likely march higher to keep pace.

Compared to richly valued data darlings like Snowflake or Datadog, this favorable risk/reward setup could lure back growth investors - after all, it's not often you can snag a cloud platform player with accelerating revenue at a modest multiple.

Remember: Oracle is no stranger to sustained, profitable growth. This company cranked out money-minting database upgrades for decades. If - and it's still a big if - Oracle brings that same operational discipline to scaling the recurring revenue cloud model, earnings could inflect faster and more powerfully than the market assumes.

So while Oracle is late, very very late, to the cloud game, its financial artillery, expanding addressable market and suddenly competitive cloud are interesting. Estimates will need to crank materially higher to capture the magnitude of an AI-fueled value-to-growth transformation. Don't be surprised to see targets of $200 or more surface should Oracle deliver another few quarters anywhere close to Q3 2024's cloud crescendo.

Still, I have been bearish on ORCL so long, I need to see some price momentum. I pay the bills with momentum. For now, I'm not short (today), and that's a big change. If you're an Oracle cloud customer, I'd like to hear from you about your results.

Disclosure: Hey! As of the date of this article I currently do not own Oracle securities or financial instruments, but please be sure to read these important disclosures anyway.