Every half century, capitalism reinvents itself through technological innovation. In the 1850s it was transcontinental railways. In the 1900s, electrical infrastructures, and automobiles. By the 1950s, atomic energy, interstate highways and aviation.

Two influential economic thinkers of the 20th century, Nikolai Kondratieff and Joseph Schumpeter, independently observed that capitalist economies seem to advance in 40-60 year spurts of technological progress.

This clockwork-like pattern of economic transformation was first quantified by Russian economist Nikolai Kondratieff. He identified 40-60 year "long waves" of economic growth fueled by new general purpose technologies like steel and electricity, followed by periods of slower expansion as those infrastructures matured.

Then, Austrian economist Joseph Schumpeter described the engine behind these long cycles as “creative destruction.” New innovations introduce a boom period of commercial activity and rising productivity. But eventually, opportunities for further expansion dry up, and the boom transforms into recession as the wave peaks and the technology is superseded.

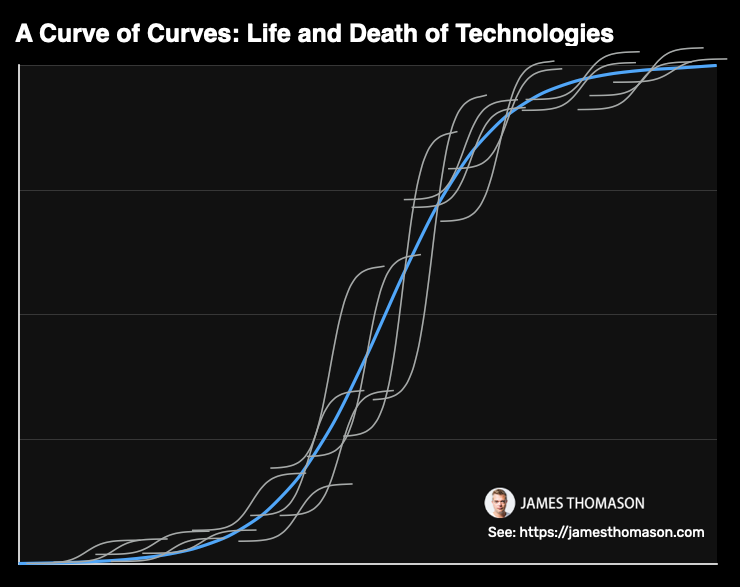

The common S-shaped curve used to depict multi-decade innovation waves is actually composed of many smaller S-curves. As business cycle expert Joseph Schumpeter described, each individual technology goes through phases of birth, accelerated development, and eventual obsolescence. While an overarching innovation wave can be said to follow an S-curve lasting 50-60 years, this longer curve consists of a succession of shorter S-curves for each constituent technology and business model.

For example, Kondratieff identified major peaks in 1920s auto and radio technology within the upward slope of the Second Industrial Revolution wave that began around the 1870s. Both automobiles and radios had their own S-curve lifecycles that fueled rapid expansion during that period. But eventually, those specific innovations matured and declined. The overarching wave of electrification lasted many more decades encompassing many such comings and goings of new technologies. Understanding both longer macro and shorter micro S-curves is crucial to tracking the real evolution of innovation.

Long Waves of Innovation

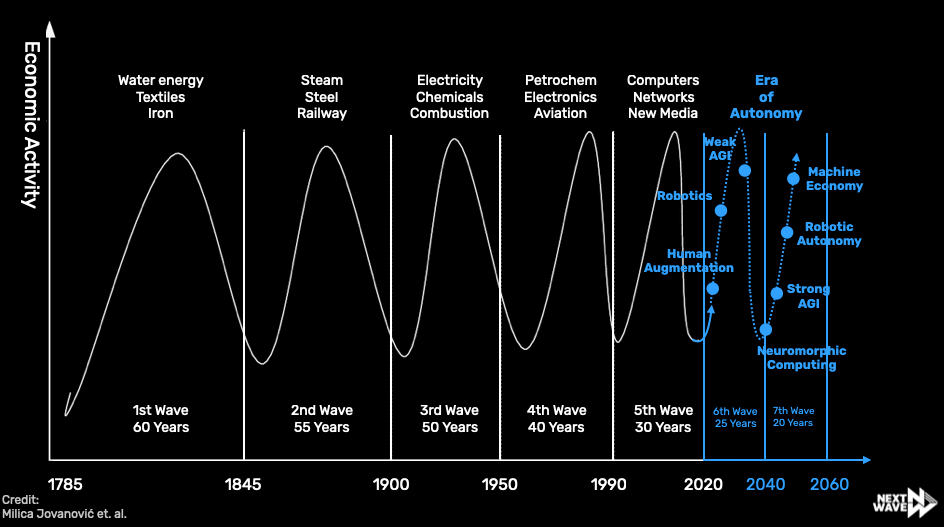

Kondratieff's theory outlines three distinct long waves of economic growth underpinned by general purpose technologies since the onset of industrialization:

The First Wave (late 18th to mid-19th century): This wave was driven by innovations in water-powered machines and the rise of the textile industry, marking the beginning of the Industrial Revolution.

The Second Wave (mid-19th to early 20th century): This period was characterized by the expansion of the steam engine, the growth of railways, and the steel industry. This wave fueled massive industrial growth and expansion.

The Third Wave (early to mid-20th century): This wave was associated with electrification, chemical engineering advancements, and the automobile industry. It represented a shift towards more complex technological systems and mass production techniques.

Subsequent to Kondratieff's death, economists and futurists continued to expand on his work:

The Fourth Wave (mid-20th century to late 20th century): This wave is often associated with the rise of information technology and telecommunications. It's marked by the advent of computers, the internet, and digital communications, which revolutionized the way information is processed, stored, and transmitted. This wave significantly influenced the global economy, leading to the rise of new industries and transforming existing ones. Economists like Gerhard Mensch, in the 1970s, contributed to identifying and analyzing this wave, focusing on technological stagnation and innovation.

The Fifth Wave (late 20th century to present): The fifth wave is characterized by digital technologies, biotechnology, and a deeper integration of IT into all aspects of life, leading to what some call the 'digital age' or 'information age.' This wave encompasses advancements like artificial intelligence, machine learning, renewable energy technologies, and advanced robotics. The identification of this wave is more diffuse, with numerous economists, futurists, and technology theorists contributing to its characterization, including the work of theorists like Carlota Perez, who linked technological revolutions to financial capital and social changes.

Both Kondratieff and Schumpeter attributed these long-run cyclical shifts largely to the self-perpetuating nature of entrepreneurial innovation. As infrastructures like railways and electrical grids are built out, they enable and demand new waves of innovation - sparking the conditions for their own disruption in a generational cycle.

Criticisms

The notions of long economic cycles driven by technological innovation have enjoyed influence, but they are not without critique. Some economists argue the evidentiary basis for 40-60 year cycles is weak given the limited modern historical data. Theoretical explanations for why such cycles should exist have also been debated. Schumpeter's view that innovation clusters due to swarms of imitators and venture capitalists spurring waves of creative destruction has been called into question. Rather than arriving in well-defined cycles, innovation may simply follow a stochastic process based on chance discoveries.

Meanwhile, other economists attribute observed long-run patterns not to endogenous processes inherent to market economies but rather to exogenous factors like major wars, global population booms, or critical resource constraints. Some present-day economic historians have largely dismissed Kondratieff waves and similar theories as lacking predictive power or falsifiability. They ascribe clustering of innovations not to deterministic cycles but rather to unique contingencies in each period.

I understand why experts criticize Kondratieff wave theories for being oversimplified. Concrete 40-60 year cycles mismatch the messier drivers behind real innovations.

But we shouldn't dismiss the valuable patterns they uncovered. Disruptive technologies still emerge in clusters, even if the timeframes aren't perfectly precise. After accelerated bursts, innovations predictably plateau for a period. Perhaps with higher connectivity, the cycles have sped up since originally documented.

However, the core insight holds usefulness. Era-defining breakthroughs herd together into windows reshaping assumptions quickly before equilibrium returns. The timeless notion of punctuated equilibrium in technology and industry still looks very valid when appraising economic history.

So while details of the theories deserve scrutiny, their wisdom in recognizing capitalism's cycle of technological revolution seems enduringly helpful. We can apply this model thoughtfully even amid rightful skepticism. The key remains properly contextualizing any framework while extracting fundamental truths. By that standard, these conceptual pioneers still very much have license to guide our expectations.

The Era of Autonomy

I predict we are now entering the onset of a new economic era that I term the “Era of Autonomy.” This consists of two interlinked waves of intelligent systems from 2025-2070.

The Sixth Wave, now nascent, will see emerging artificial intelligence, advanced robotics, self-driving vehicles, and computer augmentation profoundly enhance human capabilities. Its breakthroughs will enable the Seventh Wave - a machine economy allowing autonomous devices to build, maintain and operate other autonomous machines requiring minimal human input. Neuromorphic computing architectures modeled on biological brains along with scalable clean energy sources will support proliferating these innovations.

Intriguingly, the duration of successive technological innovation waves has drastically shortened over history. The First Wave lasted around 60 years from inception to maturity in the early 1800s. By contrast, the Fifth Wave spanned just 30 years focusing on computing and networks starting in the 1980s.

I forecast this acceleration will continue - the Sixth Wave emerging now may last only 25 years, while the rapid Seventh Wave will see transformations in less than 20 years. This pattern arises as each wave enables faster development cycles and scientific insights that seed subsequent disruptions. As the cycles loss longevity but gain pace, technological progress takes on an autonomous momentum free of human constraints.

The quickening tempo allows innovations to rapidly supersede social and political institutions, portending disruption as human systems strain to adapt to innovation trajectories charted by algorithms and experiments detached from traditional policy frameworks. Preparing to manage ever-faster cycles of creative destruction while retaining shared values presents a key challenge as the Era of Autonomy dawns.

This Era of Autonomy, founded on artificial general intelligence and unlimited automated labor, will fundamentally transform economics. I see the Sixth and Seventh long waves of innovation unfolding in three overlapping phases:

First Phase - Human Augmentation: In this phase, the focus is on enhancing human capabilities through technology. This could include developments in areas such as augmented reality, biotechnology, neural interfaces, and advanced prosthetics. Technologies like optoelectronic contact lenses, exoskeletons for increased physical strength, and brain-computer interfaces might become prevalent. The aim is to augment human senses, cognition, and physical abilities, thereby expanding the boundaries of human experience and productivity.

Second Phase - Robotic Autonomy: This phase marks a shift towards independent robotic systems. Here, robots and AI systems advance to a point where they can operate autonomously, without direct human oversight. This phase is characterized by widespread adoption of autonomous vehicles, fully automated manufacturing and service industries, and AI systems capable of complex decision-making. While this phase brings efficiency and innovation, it also poses challenges like the displacement of human labor and the need for societal adaptation to a new economic landscape.

Third Phase - Autonomous Inter-Machine Collaboration: In this phase, the focus shifts towards a self-sustaining ecosystem of machines and AI systems that operate, communicate, and make decisions independently of human intervention. This phase represents a profound evolution in autonomous technology, where systems are not only independent of human oversight but are also geared towards servicing, maintaining, and enhancing each other.

The Risks of Autonomy

By minimizing human input, the subsequent “machine economy” risks imposing an automated ideology that may overwhelm humanity’s own priorities and social contracts. However, properly harnessed, these technologies could dramatically uplift productivity and progress. Understanding the promise and perils of this impending transformation has become essential.

We stand on the brink of either transcending or toppling the prevailing economic structures and self-conceptions that define the modern age. The foundations for this new Era of Autonomy are already quickening in research and investment circles anticipating the imminent rise of advanced artificial general intelligence in symbiosis with unlimited automated labor. How we manage this transition will dictate all that follows for the remainder of the 21st century and beyond.

A little-appreciated fact is that capitalism as we conceived it was only possible alongside consistent human population growth over centuries, providing abundant labor and consumers. With birth rates now falling sharply across advanced and even developing economies, the fundamental demographic premises of modern capitalism are no longer guaranteed. Absent major policy reforms or a new economic paradigm, declining populations could severely hamper growth.

From this view, the autonomous technologies of the Sixth and Seventh innovation waves I anticipate may be civilizational imperatives to sustain prosperity. By automating labor, expertise and services through artificial intelligence and robotics, the Era of Autonomy can sever capitalism's dependence on population expansion. Automation presents solutions to boost productivity and efficiency precisely when human inputs face secular decline.

While concerns around employment impacts are warranted, autonomy may be what preserves capitalism and economic progress when its oldest pillar - demography - crumbles. With prudent management of disruptions, embracing the Era of Autonomy may prove the surest path to guarding prosperity in an aging world.

Humanity approaches an inflection of unprecedented import. Yet I believe these same innovations may rescue an economic system otherwise bound to collapse without human population expansion.

Finding the Innovation Frontiers

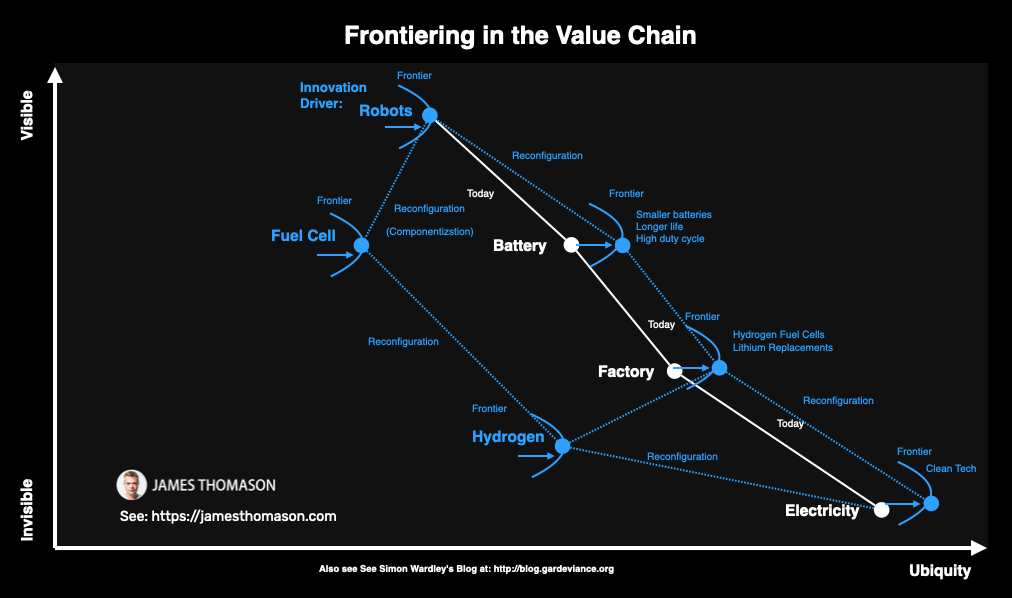

Consider technology and industry value chains - from end users down through layers of components, infrastructure and raw materials production. The leading edge of innovation occurs not just at the user level but at multiple frontier layers across this stack. When novel concepts emerge up top, like a breakthrough app or business model, significant innovations must also happen across underlying components to support these offerings.

For instance, new APIs, developer tools, cloud architectures, device capabilities, polymers, etc may need pioneering to enable the upper-level innovation. So each underlying layer races to advance in parallel. This constant imperative to "frontier" drives continual reconfiguration as new developments commoditize old assumptions. Yesterday's frontier API or material must now adapt to changing paradigms. In this sense, the frontier actually resides across each vertical, with innovations propagating up and down the chain in a contagion of change as entire value networks must transform to sustain breakthroughs occurring at any one layer.

The Innovation Frontier: A Conceptual Framework

- Definition: The Innovation Frontier represents the leading edge of value chains in both technology and industry. It's where new developments occur and where the highest value is generated before these innovations become more standardized and integrated into lower levels of the value chain.

- Location in the Value Chain: Positioned at the apex of the value chain, the Innovation Frontier starts with user-oriented innovations and extends down through various layers of technology and production, including platforms, applications, APIs, and raw materials.

- Dynamics of the Frontier:

- Componentization and Commoditization: Innovations initially emerge as distinct entities (like platforms or APIs) and over time become commoditized, serving as building blocks for newer innovations.

- Cycle of Renewal: Today's advanced technology becomes tomorrow's standard component, leading to a continuous cycle of innovation. This cycle is not linear but rather a dynamic, evolving process.

- Reconfiguration Across the Chain: As higher-level innovations become standardized, they prompt reconfigurations at all levels of the value chain, leading to new opportunities for innovation and value creation.

- Implications:

- Endless Cycle of Innovation: The frontier is in a state of perpetual motion, always moving forward as new technologies and processes emerge.

- Impact Beyond the Top: While the frontier is at the top of the value chain, its effects are felt throughout the entire chain, as each innovation triggers adaptations and new developments at every level.

- Cross-Industry Relevance: This concept applies to both digital and physical domains, illustrating a universal principle of technological and industrial evolution.

- Strategic Importance:

- Guiding Innovation Strategy: Understanding the Innovation Frontier helps businesses identify where to focus their innovation efforts and how to anticipate future trends.

- Adaptation and Evolution: Companies must continuously adapt to stay at or near the frontier, which involves not only creating new innovations but also responding to the downstream effects of commoditization and reconfiguration.

Investing in Innovation Frontiers

The "Innovation Frontier" presents immense investment potential to ride long waves of technological change. By definition, the Frontier resides on the bleeding edge wherever new breakthroughs are propelling shifts in user needs and industry dynamics. This demands looking beyond just startups to also include established vertically integrated players. Startups may pioneer risky novel use cases or features, but prove unable to scale solutions requiring substantial hardened infrastructure or supply chain coordination. Conversely, large channel-driven incumbents with existing integration struggle with rapid iteration.

Thus across the stacked technology and production layers - from end users to raw materials - the Frontier contains a mosaic of opportunities suited to both venture capital and public equity. Tracking Frontier movements reveals where new paradigms are gaining momentum to inform investments able to compound over long time horizons. This approach targeting innovation across value networks boosts exposure to non-linear growth well before concepts solidify into mainstream infrastructure. By bridging startup agility and incumbent stability, portfolios can mirror the innovation topology to maximize asymmetrical outcomes.

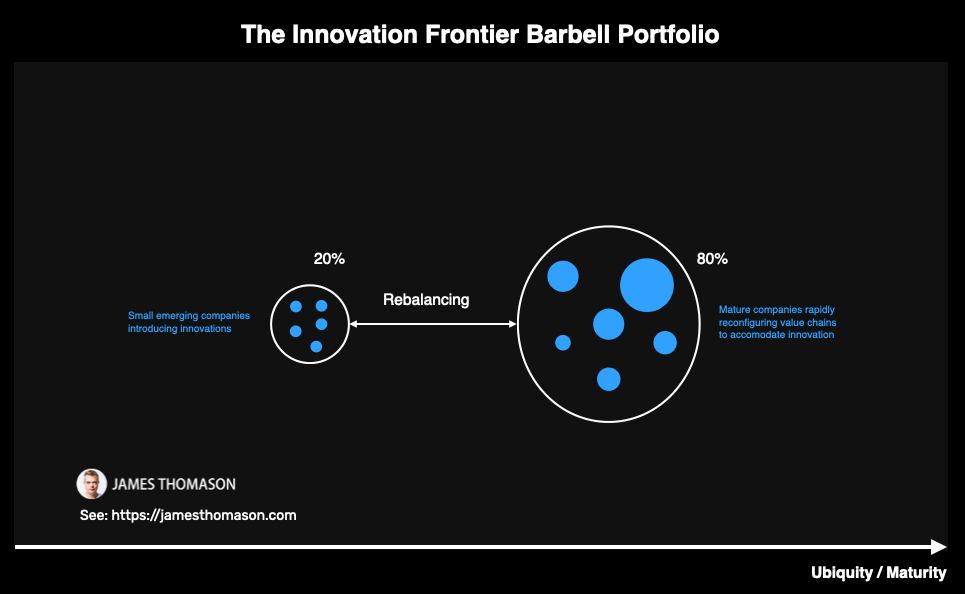

The optimal investment method targets two engines of innovation across fluid technology and industry value chains:

- Agile Startups

Fund emerging companies pioneering wholly new high-level solutions - technologies, applications and business models that reshape user experiences, developer capabilities or platform interactions. These fledgling innovators provide leveraged upside from paradigm shifts gaining momentum before widespread validation. - Dynamic Infrastructure “Reconfigurers”

Identify late-stage scale players in established downstream positions who are best positioned to adapt core existing channel dominance, supply chain leverage and customer trust by reorienting investments and partnerships into breakthrough spaces bubbling up. This stabilizes returns by riding the same disruption waves swelling startup valuations but through mature vessels more resilient to capture markets-at-scale.

Continually rebalancing exposure between these dual innovation sources mirrors the dynamics reshaping fast-moving value chains. Tracking which specific layers lead in pushing the frontier guides rotations between upstream startup risk and downstream scale maturity. When new platforms emerge, fund generation-defining developers. As underlying infrastructure must then race to overhaul pipelines, pivot to incumbents retooling existing advantages.

This framework translates observable innovation frontiers into an investable barbell strategy between two replicable cohorts. The downstream establishment base dampens volatility from speculative individual startups, while small upside concentrations contain reward asymmetry. Just as technology transitions prove that no inertia lasts forever, no insurgent remains an upstart indefinitely either to warrant isolationist strategies.

Want more?

In the next few editions, I’ll be exploring major investment themes and opportunities in 2024 emerging from the dawning Era of Autonomy – spanning artificial general intelligence, cloud, autonomous vehicles, new computing architectures, quantum mechanics, satellite infrastructure, hydrogen energy systems, and many other innovations enabling the machine economy.

As machine learning escapes labs to reshape economics, both high-potential startups and disrupted legacy sectors warrant analysis. The implications across transportation, logistics, manufacturing, construction, agriculture, and more herald immense capital allocation potential before the mainstream financial consensus catches up.

Over upcoming articles, I will explore this vast investable landscape rapidly taking shape to highlight promising early-stage technologies. Finding and supporting the breakthroughs poised to transform trillion-dollar industries is our goal.

For over two decades, I’ve been deeply involved in building disruptive tech startups, investing in innovation, and developing analytic frameworks to capitalize on cycles of creative destruction. But throughout my career, when working with employers or partners, I’ve had to shade the full picture conforming to external agendas.

This newsletter represents an experiment to see if I can freely analyze accelerated change through an independent, direct-to-reader lens not beholden to any agenda beyond evidence-based truth and mutual success.

I'll be revealing many of my core analytical frameworks and recent insights in the next few months. However, in the future, such proprietary insights will likely be reserved for paid subscribers. But right now, as an early reader, you will lock-in permanently discounted pricing just by being a free subscriber today. So, please subscribe for free!

I believe savvy investors can ride seismic economic shifts by tracing predictable generational innovation patterns, and that the outsized gains will come to those who take conviction early before financial orthodoxy catches up.

Please join me exploring ever-advancing frontiers constantly reshaping reality into opportunity. Having you along for the ride would be my honor as we discover a more empowered investing paradigm aligned to exponential technological forces.