As the market held its breath awaiting the Fed's interest rate decision last week, the tech world was abuzz with excitement surrounding Nvidia's Global AI Conference (GTC).

Concerns over inflation, economic growth, and geopolitical tensions dominated, while Nvidia showcased the relentless march of artificial intelligence and its potential to transform everything. Meanwhile, Extropic, a startup claiming groundbreaking advancements in AI hardware emerged out of stealth, and we finally saw the Reddit IPO. Plus, what does the recent Chinese ban of US chips in government systems mean for semis?

Macro

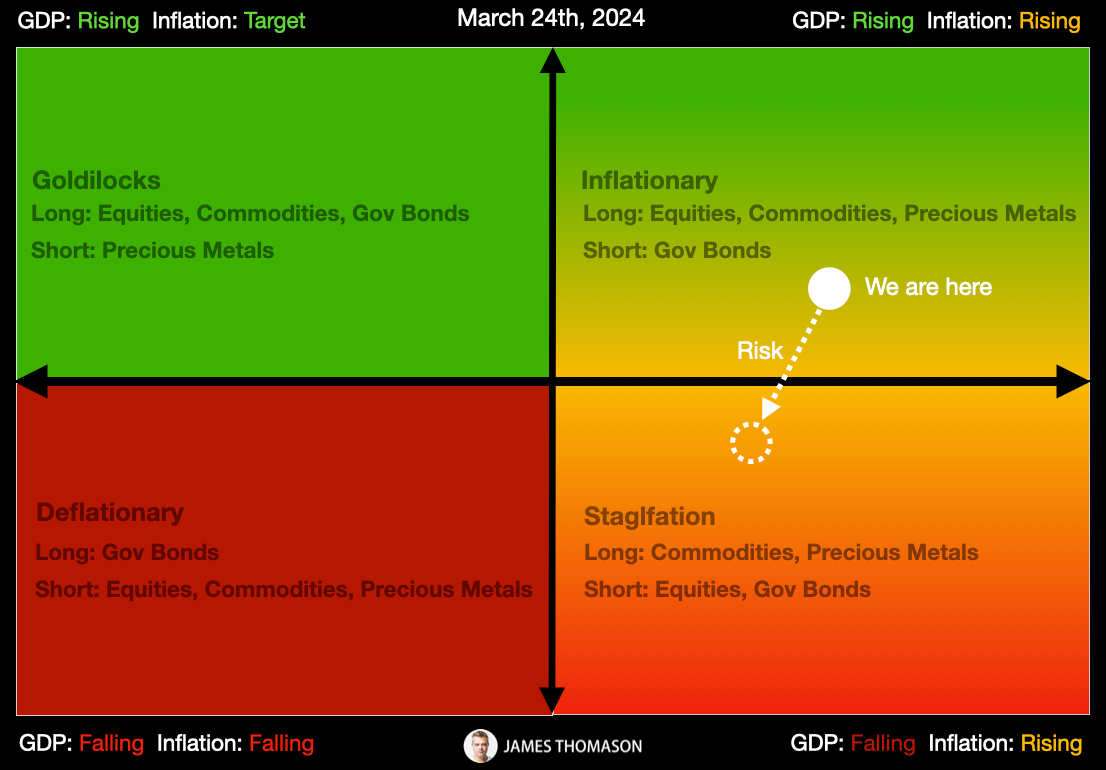

In summary, the Fed held rates, the economy is growing but decelerating, and inflation is not tamed. Apart from the escalation in the Ukraine and Israel conflicts, the biggest risk I see is deceleration of GDP growth and increased or sustained inflation that puts us into stagflation in Q2.

Given Fed reluctance to change policy into the election window, July through November, rate cut probably has to be June if it’s happening. My view is inflation and growth worsen between now and June, but seasonality in certain services, energies, discretionary, and staples will be mitigating factors.

This puts us here in a "weak long" positioning where our net exposure is limited or market-neutral and our use of leverage is reduced. We will get a lot of macro data in the next 15 days that could change our view. There is not much in the way of macro catalysts this week however.

GDP

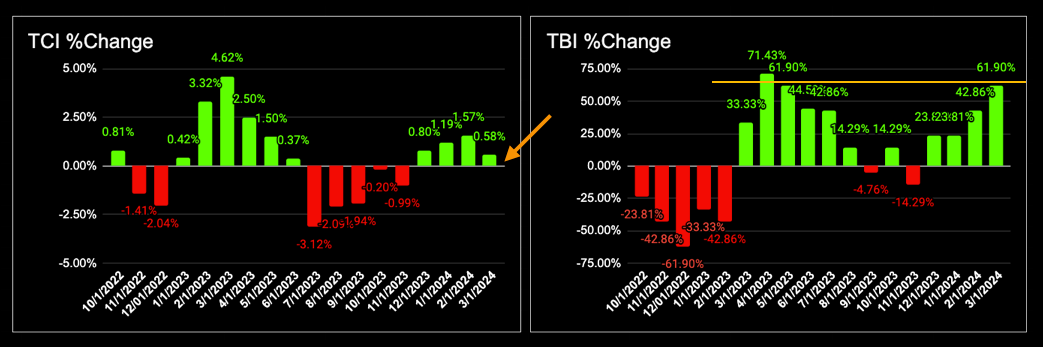

The latest Flash PMIs suggest output came down slightly from February but is still signaling solid growth, with the manufacturing sector seeing an acceleration. Our models (TCI and TBI below) suggest GDP growth has peaked in the short term. However, based on the latest Flash PMIs from last week, manufacturing in the US and Europe continues to show signs of life.

Inflation

In the latest PMI and Flash PMIs, input costs rose at the fastest pace in six months amid wage pressures in services and higher commodity prices. Selling price inflation hit an 11-month high. This indicates inflationary pressures are picking back up in the U.S. after cooling in recent months.

Jobs

Like it or not, California is the premier economy in the United States. Historically, California unemployment has been a decent predictor of recession and market corrections.

Credit

High cost of borrowing and tight credit is impeding new building permits which remain below their pre-Covid trend. Consumer savings is depleted, all Covid savings gone, but consumers are still spending. This could turn into a drag on consumer spending.

Market

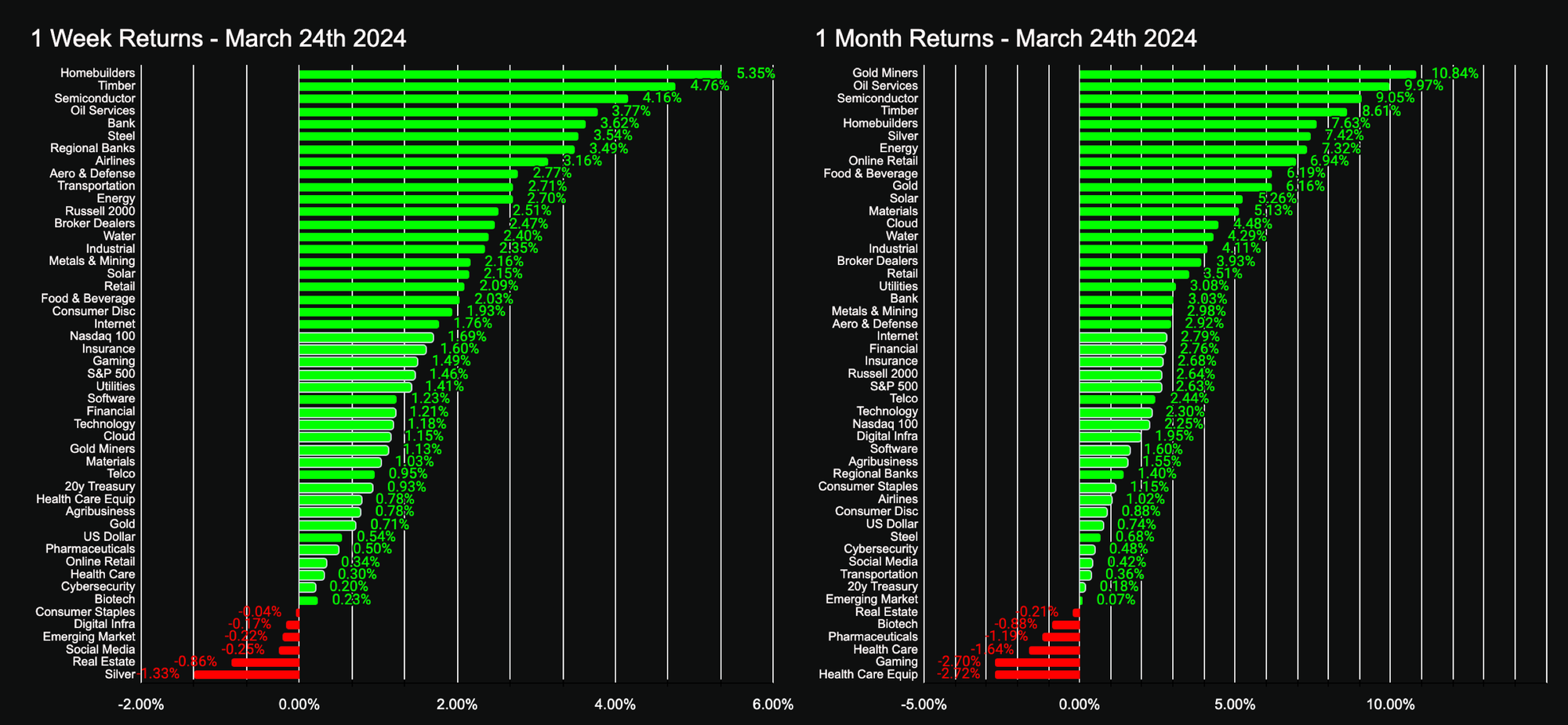

It should go without saying that in tech Semiconductor returns have been stellar, but there are signs momentum in tech overall is waning. Momentum has been in consumer discretionary, finance, energy, and staples. The recent uptick in gold and mining stocks reflects, in my opinion, leading indicators of inflation that suggest the beast is not yet tamed.

Tech Pulse

My view is earnings momentum will continue to wane in Q2 for SaaS and Cloud due to layoffs and budget tightening, but capex in AI supports semis and certain infrastructure. Assuming the bull continues to run, I will be sharing analysis here of some of these names as we pick them up over the next few weeks.

Arm ($ARM)

As the trade tensions between the United States and China intensify, with China banning the import and use of US chips in government systems, Arm might be the winner in this technological tit-for-tat. The chip design firm is well-positioned to capitalize on China's efforts to boost its use of domestic processors.

According to the Financial Times, the Chinese government plans to phase out Intel ($INTC) and AMD ($AMD) chips from its PCs and servers, favoring its own domestic alternatives instead. This could benefit Arm, as many of the alternative processors are likely to be based on the company's architecture.

The consensus high target on Arm is $180, while our own valuation model puts Arm at $138-$145. Accordingly, I had no intent to trade Arm at the moment, but I'm looking for a break of $150 to get involved.

Nvidia ($NVDA)

Wearing his signature tech-bro-meets-rock-star leather jacket look, CEO Jensen Huang truly looked the part this week with his celebrity entourage. Besides attracting the entire IT executive and professional crowd, perhaps in a throwback to the dotcom bubble, the conference was weirdly a draw for a number of notable celebrities, including George Lucas, Kendrick Lamar, Nas, Trevor Noah, and Ashton Kutcher. However, I haven’t seen any sock puppets, yet.

Was the market impressed with what it saw at GTC? Not really, NVDA has traded up about ~5% on the week as of the close, correlated with the positive moves in the indices on Wednesday and Thursday. We saw what we expected to see, incremental improvements to the Nvidia product line-up, better, faster, cheaper. Well, not so much the latter.

Here’s a quick roundup of the reveals:

1. Blackwell: The new AI chip touted as a “platform”, which Nvidia claims has 2.5x the performance with up to 25x energy savings.

2. DGX SuperPOD and GB200 NVL72: A big f***ing liquid-cooled cluster

3. Project GR00T: A foundational model for humanoid robot learning.

4. OpenUSD Omniverse digital twins: Coming to the Apple Vision Pro face hugger.

5. Earth-2: A digital twin of Earth for predicting extreme weather.

6. Robots powered by Nvidia: Including a WALL-E lookalike from Disney Research. Robots are cool.

7. AI-driven digital twins and simulated 3D environments: Something companies might actually do one day when it becomes affordable.

8. Inference Microservices (NIMs): Speeding up generative AI deployment. Sorry, it’s impossible to get excited about the word microservices in 2024.

Overall, nothing changed my view, which is Nvidia is on a rapid collision course with the inertia barriers erected by the entire tech ecosystem. Unless Nvidia can manage a transformation to cloud, software, robotics, or has major breakthrough, they will likely hit a wall in the next year or two. That being said, upside consensus estimates put NVDA at $1400. I think that is not out of the ballpark. If momentum picks back up in semis, I'll likely trade a breakout above $950.

Reddit ($RDDT)

This forgotten unicorn of a bygone era finally went public. We did not purchase or intend to purchase shares of the IPO. The trend of IPOs in recent years has been to treat the public market as a bag-holder where the lofty numbers in the Form S-1 almost instantly evaporate in the next reporting quarter. Reddit has a strong brand and appeal for a certain narrow demographic. Anecdotally, there seems to be a lot of retail appetite for risk in this type of stock. Options begin trading March 25th and I would not be surprised to see RDDT trade up when they do.

The Information published an article on the winners and losers in the Reddit IPO. The big winner is Conde Nast (Advance) who purchased the fledgling forum for only $10M back in 2007. The other big winner would be Sam Altman, who should own some of the carry from this deal in Sequoia and Vy Capital.

However, the insinuation that Fidelity and Vy Capital lost money as late stage investors is probably not accurate, owing to the liquidation preferences and other terms in those investments.

I took a quick read of the $RDDT Form S-1 filing and took a few notes:

- Dilution: As detailed in the S-1 filing, new investors in Reddit's IPO are likely to experience significant and immediate dilution of their shares.

- Voting Power: The structure of Reddit's stock ensures that voting power remains heavily concentrated with pre-IPO shareholders, particularly through Class B shares, which have more voting rights than the Class A shares offered to the public .

- Use of Proceeds: Some of the proceeds from the IPO are earmarked for purposes that might not directly contribute to the company's growth, such as satisfying tax obligations related to restricted stock unit (RSU) settlements.

- Intellectual Property Claims: On March 18, 2024, Reddit received a letter from Nokia Technologies alleging that Reddit infringes on some of their patents. Reddit plans to evaluate these claims, indicating potential legal and financial implications related to intellectual property disputes.

Extropic

The startup Extropic.ai headed by cult leader Twitter X personality Beff Jezos (Guillaume Verdon) came out of stealth mode recently, on the heels of a $14.1M Series Seed funding round in Dec'23 led by Steve Jang of Kindred Ventures, who is known for backing Uber and Coinbase.

Extropic claims to be developing a novel AI hardware acceleration platform that harnesses the intrinsic noise and fluctuations in analog circuits to perform probabilistic computations more efficiently than traditional digital processors.

The company's new web site features a brown color theme with a floating, amorphous, shapeshifting turd. Presumably, a quantum thermodynamic turd.

Hilarity then ensued on the Internet.

But I also think it's totally unfair to compare Extropic to Theranos. Totally, totally, totally, totally unfair.

I took a read of the published litepaper to try to understand the claims. While I am by no means an expert in... <checks notes> ... "parameterized stochastic analog circuits"... or <checks notes again> ... "the most energy efficient neurons in the universe [paraphrased]"... here is my understanding of the claims.

Their key claims are:

- Using parameterized stochastic analog circuits to directly implement Energy-Based Models for generative AI tasks... hahaha. Think of it as a noisy electronic circuit that you can "tune" to generate useful patterns of randomness for certain computing tasks. On today's digital processors, generating these random samples requires significant computation and energy consumption. With Extropic's approach, they are "free".

- Achieving significant improvements in speed and energy efficiency compared to running sampling-based algorithms on digital hardware.

- Targeting specialized low-volume, high-value applications with superconducting chips operating at cryogenic temperatures.

- Developing room temperature semiconductor devices as a longer-term path to address larger markets, although this claim seems questionable.

- Building a software compilation layer to map EBMs to their analog hardware.

As for what they have currently built, the litepaper provides limited evidence. They show a microscope image of an "early device that tested several possible superconducting neuron designs" but don't provide performance metrics or comparisons to digital baselines.

The claim about room temperature semiconductor devices is particularly dubious and seems to contradict other aspects of their pitch.

Earlier in the litepaper, they emphasize how thermal noise and fluctuations are a key enabler of their approach, allowing them to harness intrinsic randomness for probabilistic computing. They even say "devices must be physically small and low power to be strongly affected by [thermal fluctuations]."

But then they propose semiconductor devices operating at room temperature, where thermal noise would be much higher than in their cryogenic superconducting chips. It's hard to see how these room temp devices could maintain the energy efficiency and sampling speed advantages touted earlier.

The semiconductor proposal seems like an attempt to have their cake and eat it too - to claim huge performance gains from specialized low-temp analog hardware but then also promise a path to mass market chips. But realistically, the room temperature semiconductors would likely face the same issues around thermal noise disrupting digital logic that they claim will limit traditional computing.

It feels like an attempt to appeal to investors by promising a best-of-both-worlds scenario. But the two paths (cryogenic superconductors vs. mass market semiconductors) have very different engineering constraints that make a unified approach tenuous at best.

The claim of room temperature superconductors has been a recurring theme in the history of physics, with many past claims turning out to be premature or unsupported. However, (I think) Extropic is not claiming to have developed room temperature superconductors.

What (I think) Extropic proposes is using superconducting devices at cryogenic (very low) temperatures for their most efficient AI accelerators. Separately, they suggest developing semiconductor devices operating at room temperature as a way to scale their technology, but these would not be superconductors.

The idea of room temperature superconductors has been a holy grail in physics for decades. Superconductivity allows electrical current to flow with zero resistance, but it typically requires extremely low temperatures, which limits practical applications. Many previous claims of high-temperature or room-temperature superconductivity have failed to hold up under scrutiny.

I am sure we will (have to) hear about this startup for some time as the AI wave continues, we'll see if the claims hold up to actual use and commercial interest.

Disclosure: Hey! As of the date of this article I currently own or actively trade some of the stocks mentioned in this article. Please be sure to read these important disclosures.

Note: Due to an error this article was published one day late on March 25th, 2024 to mailing list subscribers instead of March 24th, 2024.