Just as it was declared dead and buried, volatility is back, baby. This week has everything: inflation, earnings, options skew, World War III—what more could you ask for—a rally? I don't think so. This bear is here to kick ass and chew bubble gum—and it's all out of gum. It's a tough environment for tech stocks, let's discuss why.

Macro

Missiles and drones falling from the sky tends to increase volatility, it seems. As volatility increases, risk increases. Risk comes off, things get sold, volatility increases, which increases risk again... you get the picture.

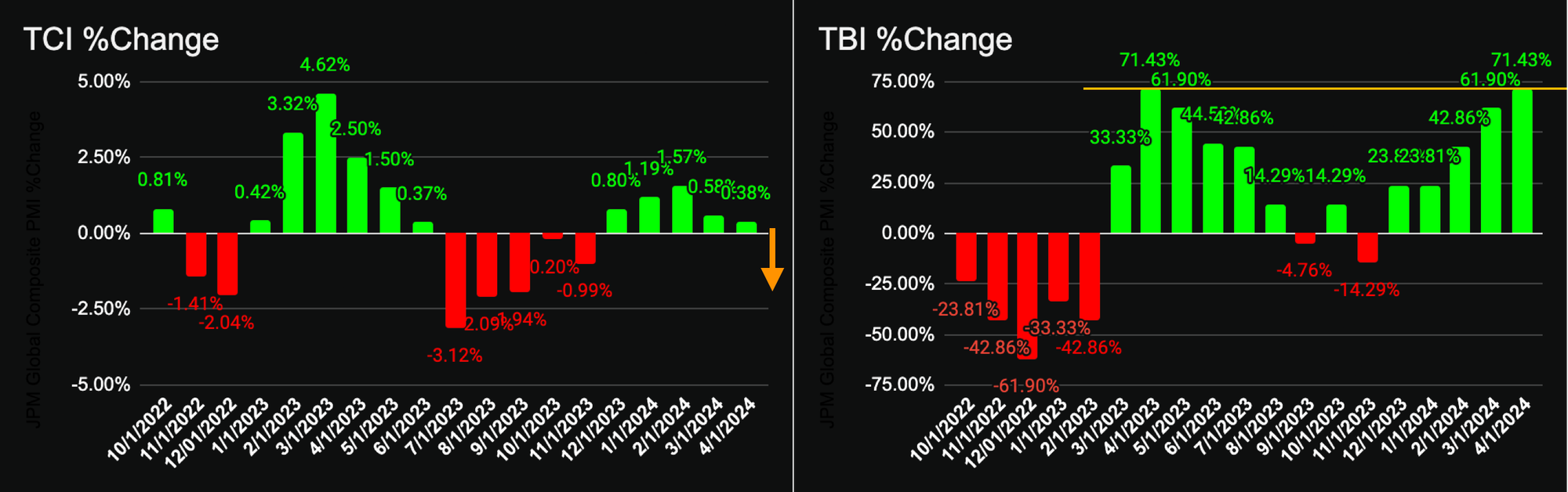

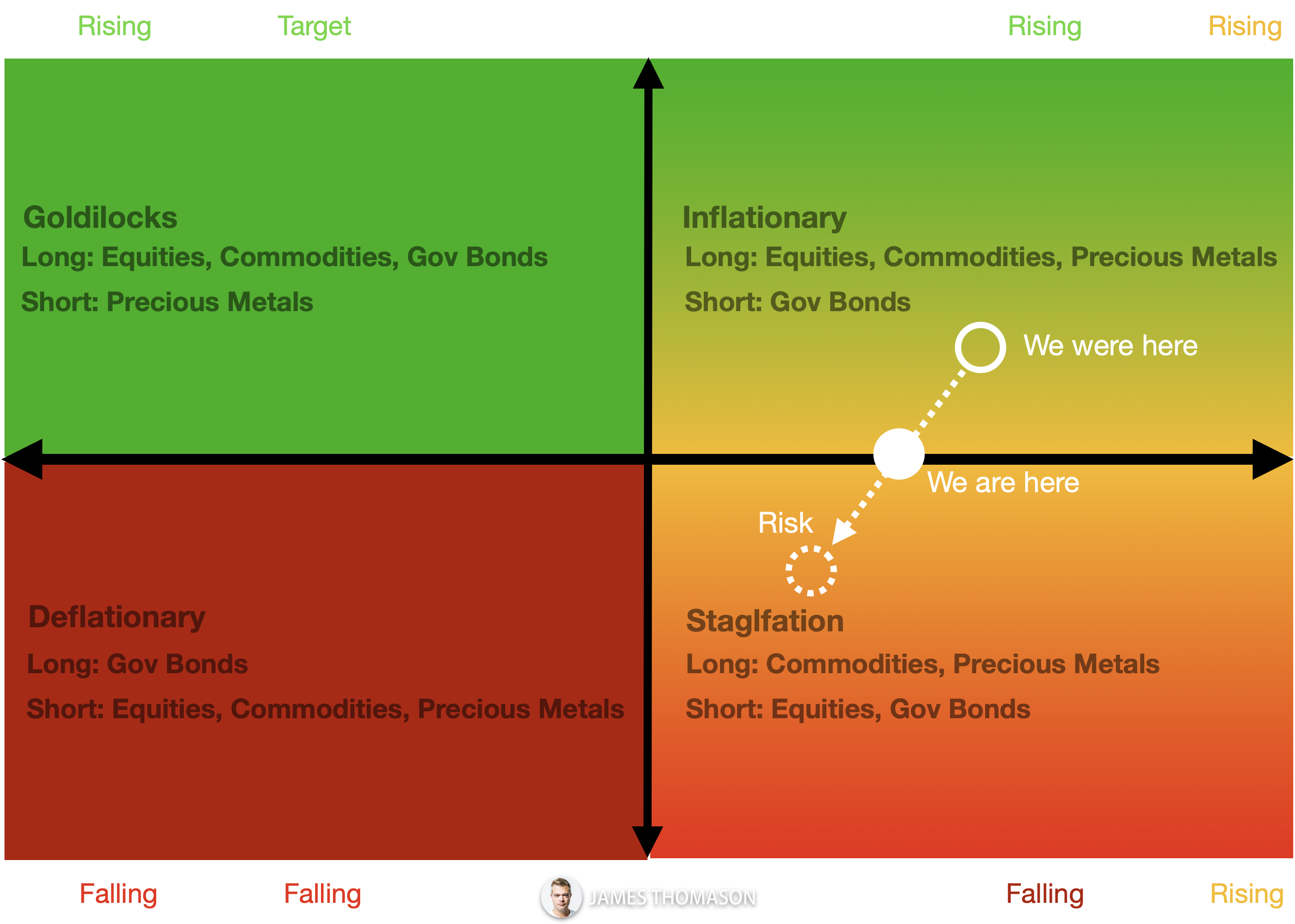

Back on March 24th, I wrote about the situation: inflation persisting, GDP slowing. We are moving into stagflation territory, bearish for equities and bonds, bullish for commodities and precious metals. The ensuing two weeks have strengthened the case, let's look at why.

GDP

We had a lot of macro data in the last two weeks, most importantly the PMIs and inflation data. A deep dive into the sector data suggests GDP growth continues to slow and is on the edge of contraction.

Inflation and Credit

Price inputs and outputs increased across almost all industries for the fourth report in a row. Meanwhile, the money supply and PCE also continued to increase. I believe rate cuts are now out of the table if the Fed is serious about its mandate. Though as I wrote previously, given the political polarity in the US, the election year, and now the geopolitical uncertainty, it is not out of the question (in June).

Positioning

My view is that GDP momentum continues to slow into Q2, with the potential for negative earnings surprises and/or lowered guidance. This shifts us from a "weak long" to a "weak short" positioning in equities, long volatility, and active trading in Gold and Silver. Our risk and target leverage is reduced, we are actively trading and taking a few positions around earnings and other event catalysts.

Market

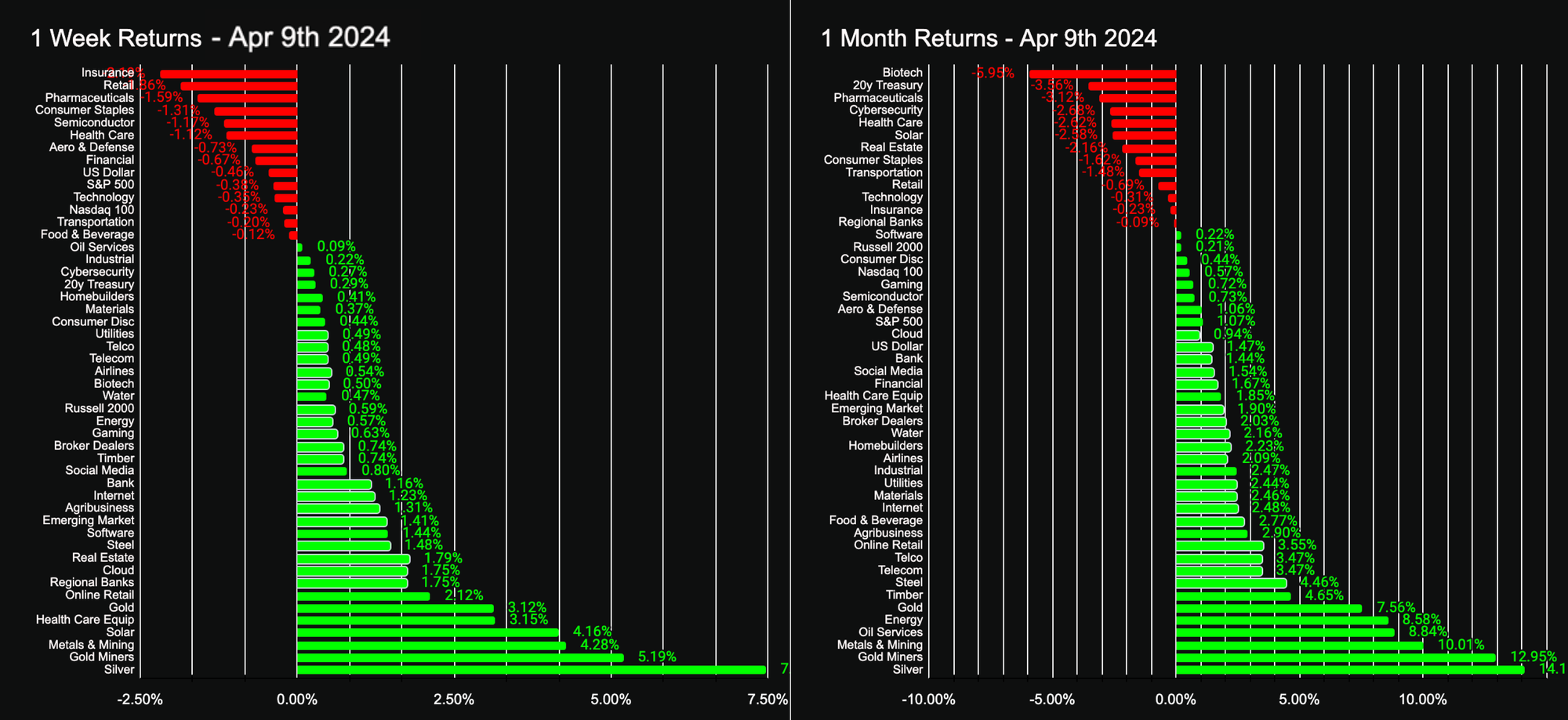

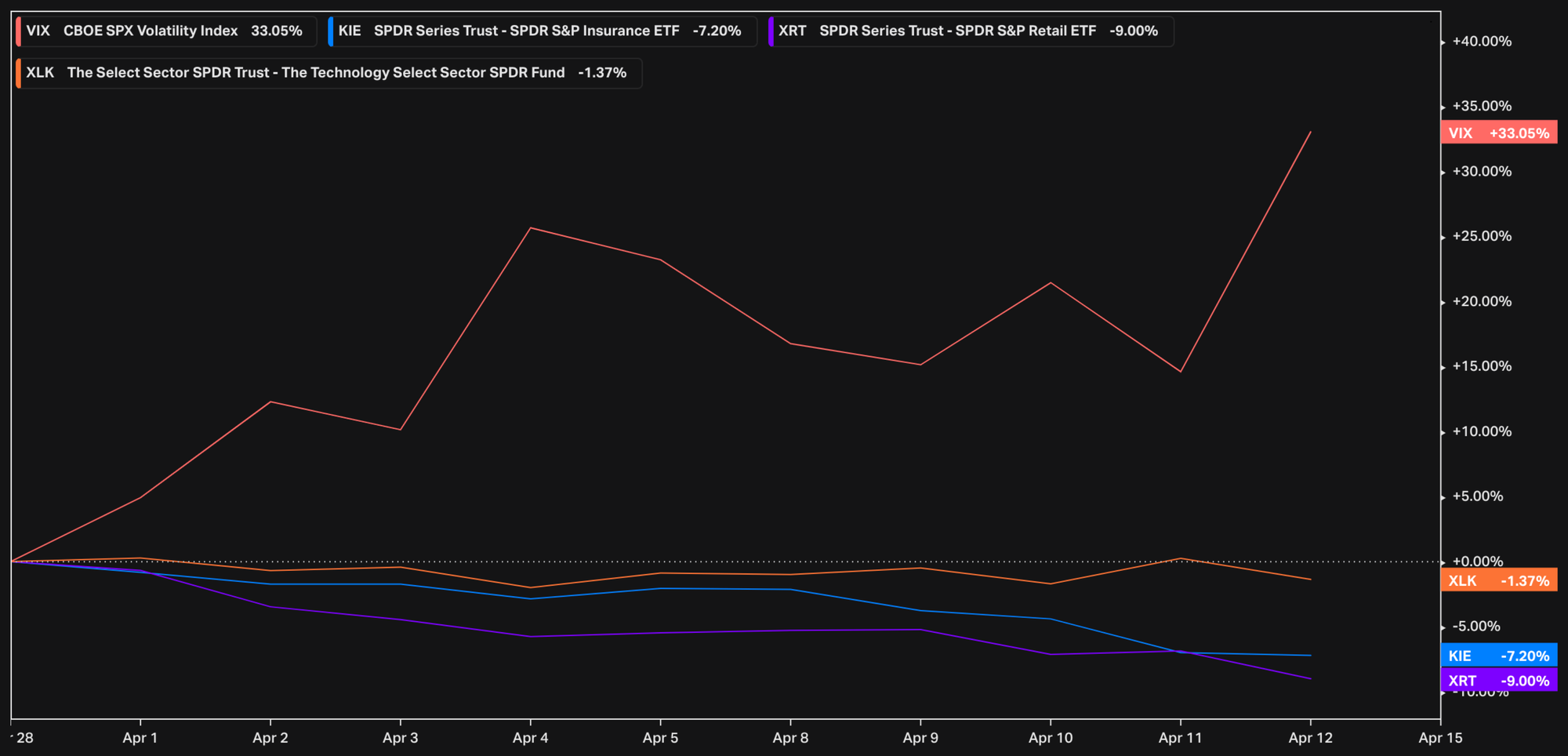

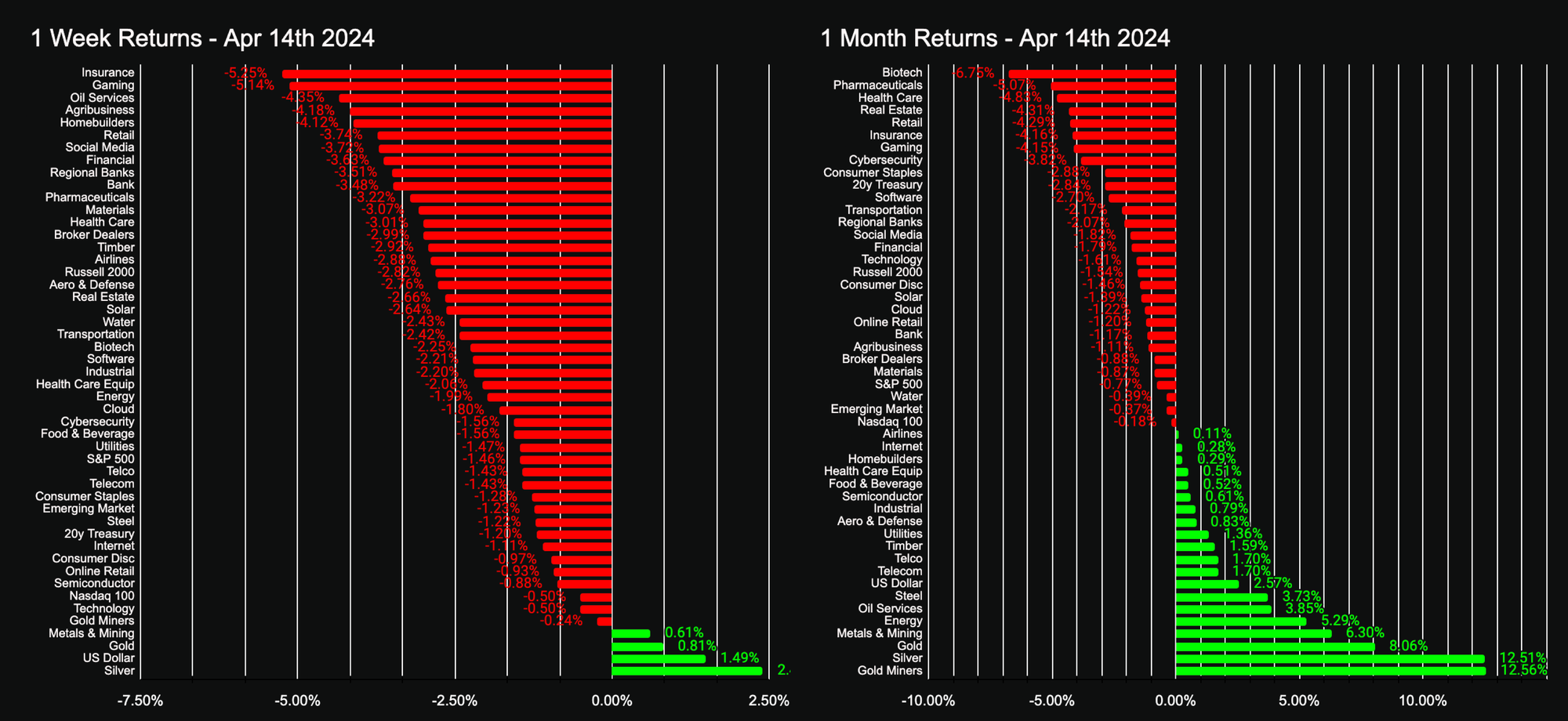

Returns across industries certainly lend support to the view. Since January, Insurance has been extremely strong, and Retail quite strong, both in terms of PMI and market returns. Consequently, the rotation into previous metals and miners week of Apr 9th was an important signal.

The move preceded by a +10% increase in the VIX and then further correlated to a subsequent 15% increase in the VIX.

The following week, catalyzed by the escalating Iran-Israel conflict, is a likely prelude to the rest of this earnings season, as move this broad tends to be indicative.

Tech Pulse

Large layoffs in big tech continue. Apple, IBM, Dell, Ericsson, and many smaller firms and startups reported or announced intention to layoff in the last month. Today, Tesla is rumored to be laying off more than 10% of its staff ahead of earnings. According to the tracking site Layoffs.fyi, 255 tech companies have laid of 75,000 workers so far in 2024.

Next week kicks off tech earnings season, with Microsoft ($MSFT), Google ($GOOGL), Amazon ($AMZN), Meta ($META), Tesla ($TSLA), and Intel ($INTC), all reporting. We will do a deep dive on some of these companies in the next few days, stay tuned.

Venture Capital

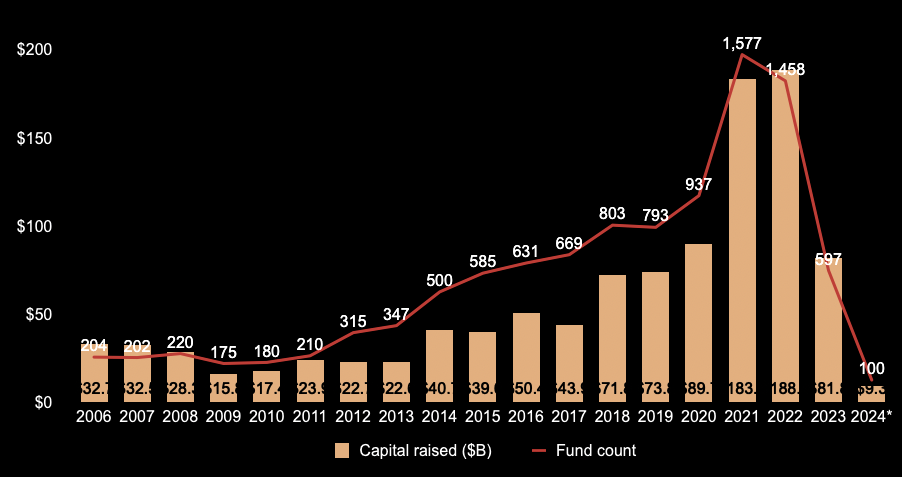

According to data from Pitchbook and NVCA, only 100 new VC funds were launched in Q1 2024, raising just $9.3B from investors. This means the industry is on track to repeat the dismal startup funding environment of 2009-2013.

The VC funds that survived this period following the financial crisis often hail it as a prime vintage that gave us outliers like Facebook, AirBnB, Uber, Pinterest, Twilio, Square, etc. That's true enough.

Less often told is the story of ripple effects. Struggling startups slash spending on software, SaaS, services, technology, and other B2B purchases. Simultaneously, laid off highly paid tech workers curtail discretionary spending, downsize, dispose of assets.

The reality is a bad VC environment is terrible for discretionary and high-growth companies, as well as financial companies that specialize in this area. It's also bad for retail, suppliers, and services business in the markets where VC underwrites GDP (San Francisco, New York, Seattle, Los Angeles, Austin).

The Takeaway

The convergence of geopolitical tensions, persistent inflation, slowing GDP growth, and a weakening venture capital environment paints a rather gloomy picture for the economy and equity markets in the short term, particularly the technology sector. Meanwhile, the Fed is trying to control inflation while the Federal government is running large scale stimulus spending. It is hard to see how the US economy dips into recession while running a $1.5T budget deficit without a catalyst like significant escalation in the Iran-Israel or Russia-Ukraine conflicts. Overall, a murky, volatile situation with likely short term downside (read: opportunity).

Disclosure: Hey! As of the date of this article I currently own or actively trade some of the stocks or financial instruments mentioned in this article. Please be sure to read these important disclosures.