I can remember once, long ago in the before times, when the bitcoin bros were all silent as the grave. I believe the year was 2022, when the so-called future of money was down about 70% from its then all-time-high of $64k.

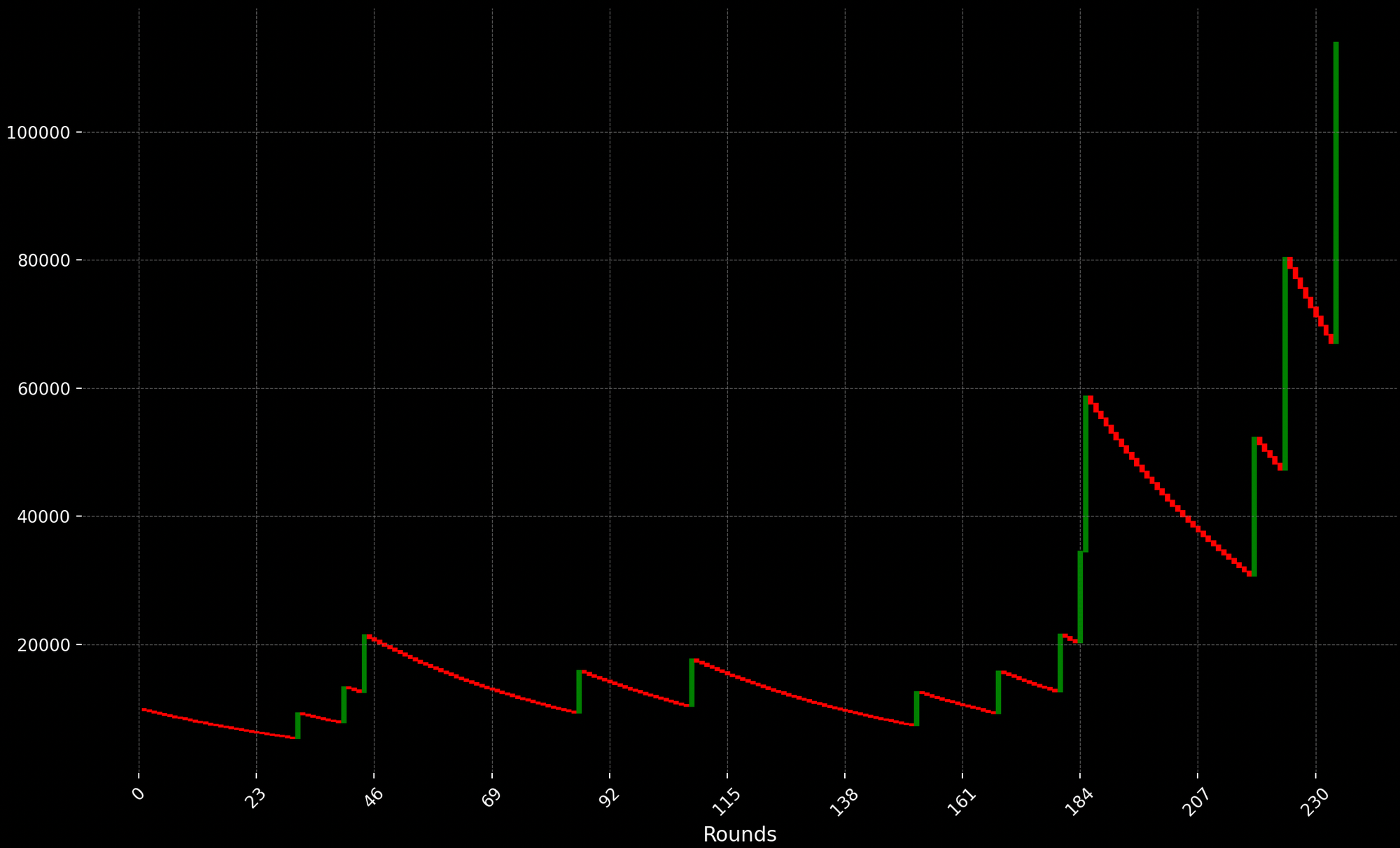

The fact Bitcoin recently crossed the much anticipated $100k mark still doesn't make it a great investment. It does, however, make the crypto bros a lot more annoying. I give you the Bitcoin chart.

Just kidding, this is a simulation of a roulette equity curve. Granted, it looks remarkably similar to a recent Bitcoin chart, and for good reason. Player #371 in our simulation achieved equity of $113972.14 in only 230 trials, a remarkable performance.

Player #371 is now a Very Smart Person (VSP). He drones on incessantly about how roulette as a store of value, writes blog posts and e-books about his betting system, is invited to make guest appearances on CNBC and Bloomberg. You've seen him, I'm sure.

I bring up roulette because if you enjoy negative expectancy games, high volatility, and don't mind losing everything, you might as well play roulette. For one thing, casinos are highly regulated so you're guaranteed a fair game.

For another, the game is faster, so you don't need to hodl (read: baghold) through the next crash. Sure, you'll certainly go broke if you play long enough, but the same is probably true of Bitcoin. Hey, I'll even sell you Player #371's "system" for a few hundred bucks.

Look, I'm not talking to the professionals, the banks, hedge funds, market-makers who are trading BTC. That's just business as usual. Traders trade anything that trades. If it ticks, they clicks.

Bitcoin needs liquidity. Bitcoin needs options. Bitcoin needs convertible-debt-fueled ponzi schemes and all that. I get it. I'm talking to you, the rational investor, the bagholder.

Because, if you were a rational investor looking to maximize your returns, there are so many better ideas. There are real companies, doing real things, with real products, making real money. A lot of it.

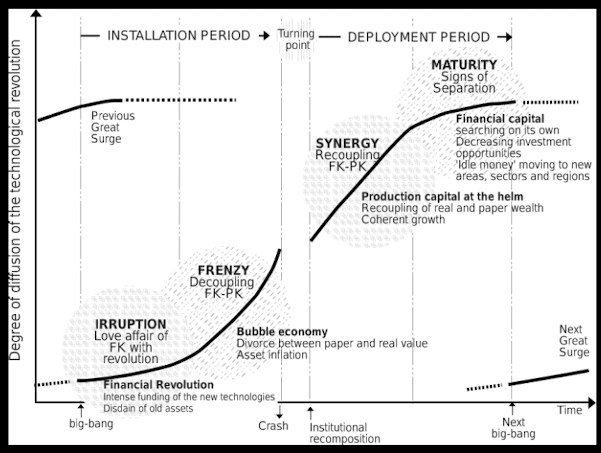

Mercifully, this will all be over soon, bro. Actually, this will all be over soon, again, again. Because that's all we have now, just a vicious cycle of asset inflation, deflation, and re-inflation at the inflection of a technological long wave. Can you feel the end coming? I can, because I've seen this movie before. It's my third or fourth once-in-a-hundred-years asset bubble. It's getting old even.

It's what researcher Carlota Perez describes as a "frenzy", a decoupling of financial capital from production capital. Perez identifies this pattern across several technological revolutions over the past 200 years, including the Industrial Revolution and the Information Age.

Each cycle typically spans 50 to 70 years and consists of distinct phases: irruption, frenzy, synergy, and maturity. The frenzy phase usually culminates in a financial crisis, which serves as a corrective mechanism that eventually re-establishes the connection between financial capital and production capital.

After the crisis, the golden age represents the period when the new technological paradigm reaches its full potential, benefiting society more broadly after the excesses of the frenzy phase have been corrected.

The problem is, in the case of the long wave of the Digital Age, we never reached the golden dream. Despite the popping of the dot-com bubble, the supposed alignment between financial capital and production capital never emerged. Instead, financial capital decoupled again and gave us the innovations of the Great Financial Crisis.

The Great Financial Crisis was the logical endpoint of financial capital's first major decoupling from productive enterprise in the digital age. After the dot-com bubble burst, instead of reconnecting finance with production, we transformed housing - the most basic of human needs - into a casino.

Through the magic of mortgage-backed securities, collateralized debt obligations, and credit default swaps, financial institutions turned simple home loans into complex betting instruments. When it all collapsed in 2008, global financial markets froze, major institutions failed, and $8 trillion in housing wealth vanished.

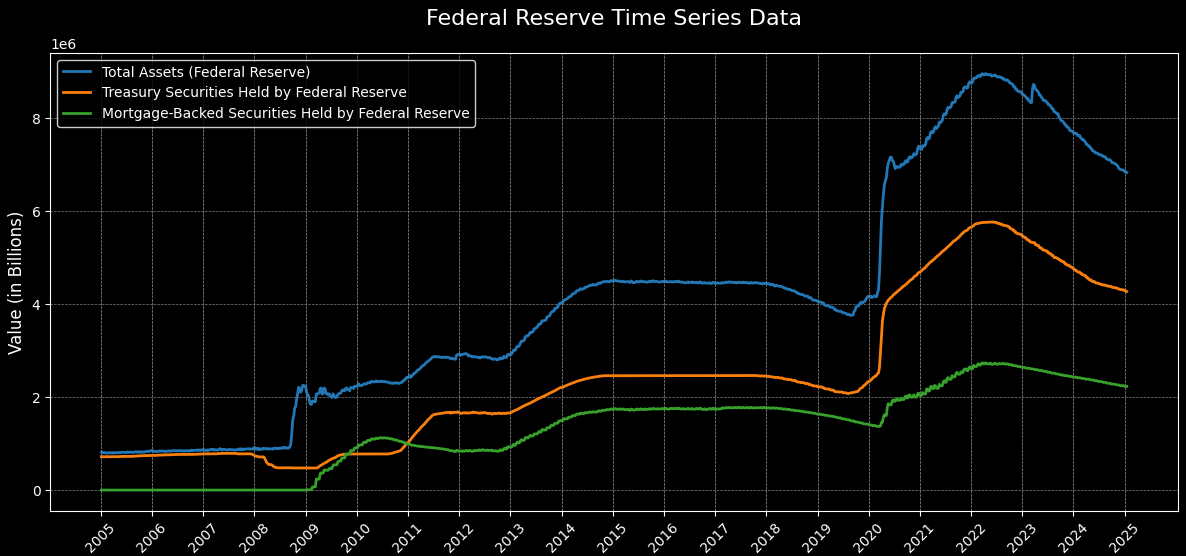

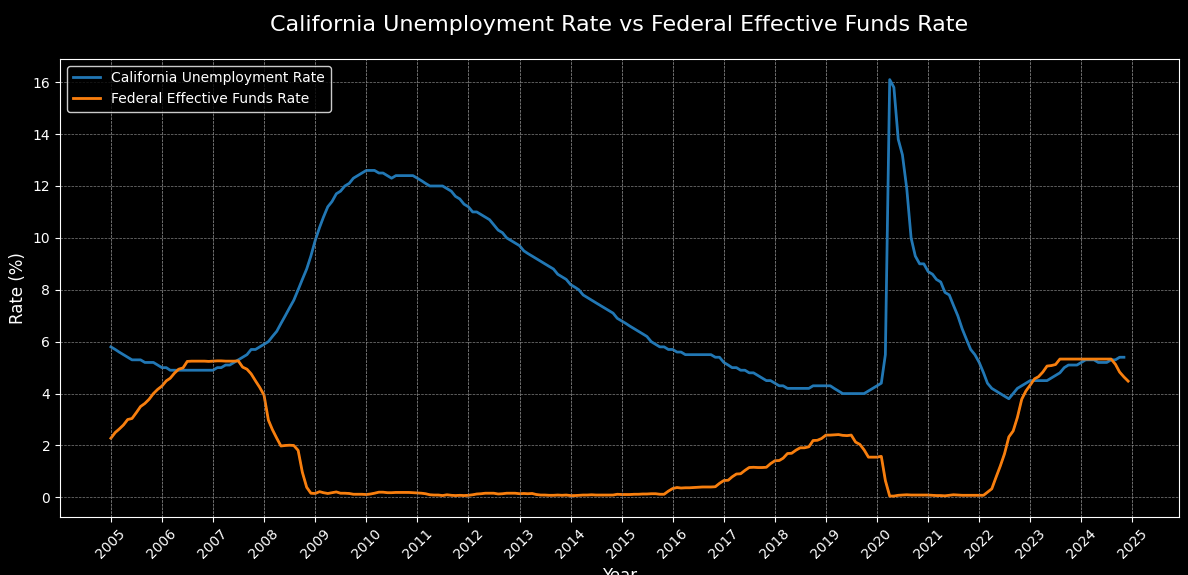

The response was telling. Rather than forcing a reconnection between financial and productive capital, central banks and governments chose to rescue the financial sector largely on its own terms. The Federal Reserve's balance sheet exploded from $900 billion to $8.5 trillion through quantitative easing. Interest rates were cut to near zero and kept there for years. While this prevented a complete economic collapse, it also laid the groundwork for our current predicament.

Because here's what happened next: all that cheap money, instead of flowing into productive investment, simply inflated new asset bubbles. The stock market quadrupled between 2009 and 2021. Housing prices soared past their pre-crisis peaks. And most tellingly, we saw the rise of assets that were purely speculative by design - cryptocurrencies and meme coins being the most obvious example.

It seems the "frenzy" phase in previous technological revolutions has, for the moment, become a permanent state of speculative detachment. After the dot-com bubble and the 2008 crisis, instead of financial capital reconnecting with real production, we just create new casinos.

First housing, then crypto, and now the AI gold rush. Instead of using the moment to reshape the relationship between finance and the real economy, we doubled down on financialization. We're now at the logical endpoint.

Here's where it gets interesting: unlike previous bubbles that were purely financial in nature, the AI boom carries the seeds of its own deflationary collapse through actual productivity gains. When a crypto token crashes, nothing of real value is lost – it's just gambling chips changing hands.

But AI's impact on knowledge work creates genuine displacement effects that ripple through the real economy. A laid-off programmer or content creator doesn't just lose their paycheck because they reduce spending across multiple sectors, amplifying the deflationary pressure.

This is the trap we're walking into. Speculative capital is pouring billions into AI development, driving a market mania disconnected from fundamental value (classic Perez frenzy), while simultaneously funding the very technologies that could trigger widespread deflation through digital overproduction and labor displacement. It's as if we're building a giant casino on top of a machine designed to systematically reduce the gamblers' ability to place bets.

The AI Deflationary Spiral

What follows is a thought experiment and timeline of how AI-driven deflation, coupled with policy shifts and market dynamics, could cascade through the economy over the next several years.

This scenario draws on historical parallels, particularly the deflationary spiral of the 1930s, while recognizing the unique characteristics of our digital age.

One key difference is the speed at which AI can scale and disrupt once infrastructure is in place, potentially compressing what took a decade in the industrial age into a few years.

The deflationary scenario stems from a unique convergence of technological and economic forces. Just as mass production in the 1920s created an abundance of physical goods that outpaced consumers' ability to buy them, AI threatens to flood markets with an unprecedented supply of digital goods and services while simultaneously eroding the purchasing power needed to sustain demand.

This creates a three-part deflationary mechanism:

First, AI's ability to generate content, code, designs, and other digital outputs at near-zero marginal cost means supply can increase almost infinitely. Unlike physical goods, which face natural production constraints, AI-generated products can be created and replicated instantly. This oversupply naturally pushes prices downward across digital and knowledge-work sectors.

Second, AI's displacement of white-collar workers - from content creators to attorneys to programmers to analysts - reduces aggregate purchasing power in precisely the consumer segments that have historically driven demand for both digital and physical goods. As these workers lose income or face wage pressures, their reduced spending ripples through the broader economy.

Third, businesses facing falling prices and revenues respond by cutting costs further - often through additional AI automation - creating a self-reinforcing cycle: more automation leads to more job displacement, which leads to less consumer spending, which leads to more cost-cutting automation. This mirrors the deflationary spiral of the 1930s, where falling prices led to production cuts and layoffs, which led to even less demand and lower prices.

The key difference from previous deflationary episodes is that AI doesn't just create oversupply - it systematically eliminates the purchasing power needed to absorb any level of supply by displacing the knowledge workers who have been the core of the modern consumer economy. This creates a structural break that could prove far more resistant to traditional monetary and fiscal remedies than past deflationary cycles.

This dynamic is particularly dangerous because it can persist even amid pockets of inflation in physical goods and commodities. The resulting environment - deflation in digital and knowledge-work sectors alongside inflation in necessities - creates precisely the conditions that can accelerate both job displacement and the erosion of purchasing power, potentially tipping the economy into a broader deflationary spiral.

Q4 2024: The Initial Conditions

Fed cuts rates despite persistent inflation

- Initial structural unemployment appears from generative AI

- Salesforce announces no software engineer hiring for 2025

- Early signs of knowledge worker displacement

Q1 2025: Policy Shifts

- Trump takes office with immediate policy shifts:

- New tariffs on foreign imports

- Federal employee RTO mandates

- Mass deportations begin

- Private sector accelerates RTO mandates

- Hiring freezes accelerate

- "Stargate" announcement: $500B AI infrastructure commitment

- Re-emerging inflation in industrial inputs

Q2-Q3 2025: Market Amplification

- Rising unemployment from:

- RTO mandate attrition

- Hiring freezes

- AI displacement

- Supply chain disruptions from deportations

- DOGE begins recommending federal spending cuts

- Infrastructure acceleration as Trump streamlines permits for:

- Data centers

- Electric utilities

- Alternative energy projects

- Enterprise AI adoption accelerates:

- Internal business process automation

- Customer service replacement

- Back office automation

- Real Estate Decline:

- Residential markets weaken

- Commercial real estate deterioration continues

Q4 2025: Structural Shifts Intensify

- High-wage job displacement accelerates

- Supply chain disruptions and labor shortages worsen

- Real estate decline accelerates

- Federal spending cuts begin impacting economy

2026: The Deflationary Cascade

- Digital content markets flood with AI output:

- Media oversupply

- Disengagement from social media

- Content price collapse (well underway)

- Enterprise software disruption:

- AI begins unbundling SaaS offerings

- Cheaper AI alternatives emerge

- Downward price pressure on incumbents

- Real estate decline continues accelerating

- Structural unemployment becomes entrenched

2027: ROI Reality Check

- AI Infrastructure investment thesis weakens:

- Software efficiency reduces compute needs

- Shift from compute to storage/networking

- Early infrastructure investments look overbuilt

- Data center ROI questions emerge

- Enterprise AI Disappointment:

- Many large AI projects fail to deliver promised value

- Complexity and maintenance costs exceed expectations

- Integration challenges prove more difficult than anticipated

2028: Rebalancing Crisis

- Enterprise AI hangover sets in:

- Companies realize over-automation mistakes

- Human intelligence value re-emerges

- But experienced knowledge workers have left the field

- Education pipeline disruption becomes apparent:

- 2026 tech layoffs caused students to flee STEM/CS

- University CS/Engineering enrollment drops

- Early signs of future skills shortage

- Infrastructure overcapacity crisis:

- Data center valuations under pressure

- Some facilities prove unsuitable for pivot to storage/networking

- Echo of 1920s factory overcapacity

2029 and Beyond: Cruel Irony

- Severe tech labor shortages emerge:

- Experienced workers have changed careers

- New graduate pipeline has dried up

- Companies desperately try to rebuild human capacity

- Market whipsaw:

- AI service prices remain permanently lower

- But human expertise commands premium prices

- Companies caught between need for both

- Infrastructure repurposing challenges:

- Massive write-offs

- Expensive facility conversions needed

- Echo of 1930s industrial stranded assets

- Structural problems persist:

- Displaced workers still haven't fully recovered

- Real estate markets remain disrupted

- Digital deflation continues in many sectors

- But acute shortages create inflation in others

Pace and Pattern

This scenario hangs on some assumptions worth poking at. First up is the speed of AI taking over jobs. Getting enterprises to actually implement new tech is a cat rodeo - legacy systems, compliance headaches, corporate inertia, you name it. The 2024-2029 timeline I've laid out here is pretty aggressive compared to historical tech shifts.

Then there's the whole "this time it's different" argument. Historically, technological revolutions destroyed certain jobs but created new ones - even if it took decades to play out. Factory automation killed craft manufacturing but eventually spawned entirely new categories of work. The case for AI being truly different rests on its unique traits: zero marginal cost for digital output, ability to handle cognitive not just mechanical tasks, and the wild card of potential self-improvement.

Following Perez's framework, what we're really describing is the turbulent end of AI's "installation period" - characterized by financial frenzy, speculative excess, and social disruption. Historically, such periods have been followed by a "deployment period" where the technology's benefits spread more broadly through the economy as financial and productive capital realign.

In that case, the key question isn't whether AI destroys or creates more jobs - it's whether we can navigate the transition from installation to deployment without getting stuck in a prolonged crisis.

Could a deflationary spiral really happen? The President of the United States is launching meme coins on his way into office. It's a frenzy– case closed. Will it happen? We'll surely find out. It's probably nothing, just a little gully.

But we know how a frenzy usually ends: badly, and sooner than you think.